Bearish Risks for EUR/USD Mount Ahead of US Inflation Data and ECB Decision

European financial markets are exhibiting caution ahead of the US CPI release and the ECB rate decision, with major indices declining moderately and losses capped at 0.5%. The common currency weakened against the US Dollar, pushing EUR/USD toward the 1.0525 level, as attempts to rise above 1.06 repeatedly failed. This has increased market confidence that overall selling pressure remains prevalent, with expectations of potential bearish developments for the European currency:

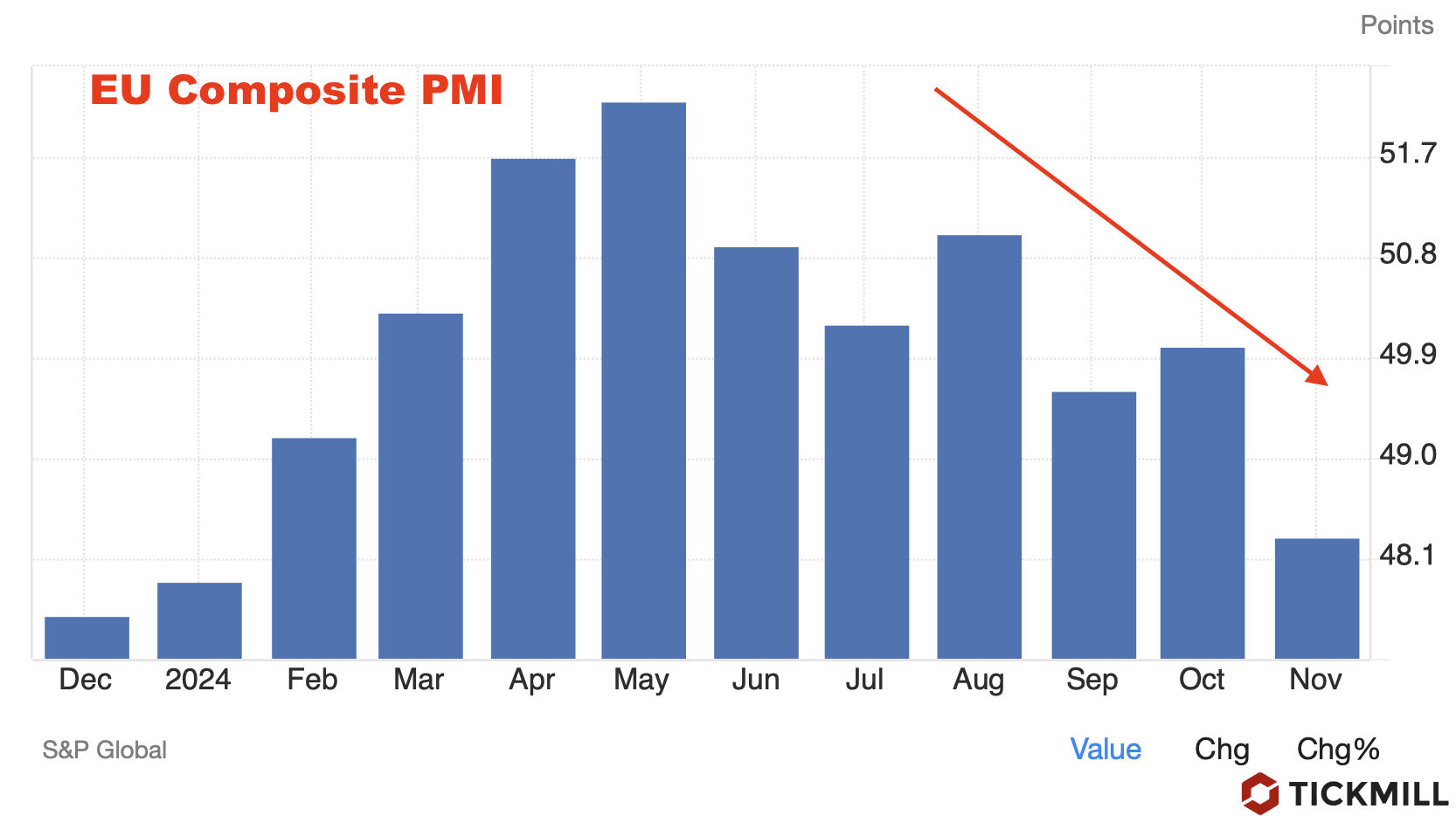

Market participants are broadly anticipating a 25-basis-point reduction in the ECB’s Deposit Facility Rate, which would bring it down to 3%. If confirmed, this would be the ECB’s third consecutive rate cut, signaling the central bank’s ongoing effort to address uncertainties stemming from political friction in key European economies like France and Germany, a pronounced slowdown in Eurozone business activity, and the potential impact of upcoming Trump tariffs. Traders seem to be betting that the ECB will respond by easing financial conditions further, hoping to reinvigorate growth and restore confidence:

At the policymaking level, the debate within the ECB remains intense. A contingent of officials suggests that Trump’s trade tariffs could push inflation higher in the Eurozone by weakening the euro against the US dollar. In practical terms, a cheaper euro would make imports more expensive, potentially lifting domestic price levels. Conversely, other policymakers worry that tariffs could weigh on the Eurozone’s export-driven industries, restraining growth and nudging inflation below the central bank’s target. The outcome of Thursday’s meeting will likely hinge on which perspective gains greater influence, potentially guiding the policy narrative well into the new year.

Shifting the focus to the United States, a stronger dollar has been exerting pressure on EUR/USD, partly in anticipation of upcoming US inflation data. On Wednesday, the US will release its November CPI figures. Consensus forecasts point to headline CPI accelerating to 2.7% year-on-year, slightly above the previous 2.6%. Core CPI, which strips out volatile food and energy categories, is projected to maintain a stable increase of around 0.3% MoM. Although these inflation readings are unlikely to radically reshape expectations for the Fed’s December 18 policy meeting, a significant deviation could still spark volatility. Currently, market-based indicators, such as interest rate futures, suggest about a 90% probability that the Fed will cut its benchmark rate by 25 basis points to the 4.25%-4.50% range.

In the United Kingdom, meanwhile, the British pound remains broadly stable against its major counterparts. This stability emerges amid a relatively quiet domestic data calendar and mounting confidence that the BoE will leave its key interest rate unchanged at 4.75% during the December 19 meeting. While UK inflation has recently climbed back above the bank’s 2% target, the BoE previously predicted such fluctuations, and officials may argue that keeping rates steady is necessary to ensure inflation returns to a sustainably low level over the medium term:

Later this week, investors will pay close attention to the UK’s October GDP release, as well as industrial and manufacturing production figures. After a disappointing September, markets anticipate signs of at least a modest rebound in these indicators. Positive surprises could reinforce sterling’s resilience and support market expectations that the UK’s economy is on firmer footing than it appeared just a few months ago.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.