BTC Bulls Reawaken

Following an almost 9% correction from last Friday’s highs, Bitcoin prices are finally recovering. BTC futures posted a solid gain yesterday, with the Daily chart printing a large bullish engulfing candle, signalling that the bull trend could well be resuming, putting fresh highs back in sight near-term. However, the recovery rally has stalled for now and the market is at a make-or-break juncture: will this prove to be a lower higher against last week’s ATH, setting up the way for a deeper correction lower? Or will the current $92k lows hold as just a corrective low within the bull trend, with price set to break out higher?

Institutional Demand

Institutional demand signals have become a key feature of analysing Bitcoin since ETFs were introduced earlier this year. The market clearly ebbs and flows in line with adjustments to Wall Street exposure. Following the record accumulation over the week prior, news of growing outflows correlated with the downturn we saw over the first few days of the week. However, yesterday’s firm rally suggests that big players are re-accumulating into the dip. Indeed, crypto analytics from Glassnode reports that its data flashed up a seller exhaustion signal into this week’s lows.

Longer Term Accounts Still Buying

Additionally, Glassnode reports that medium term holders (accounts holding BTC for 6month-1year) have seen heightened levels of distribution recently while longer term holders continue to accumulate, a dynamic which they associate with prior periods of consolidation before a fresh bull phase. As such, while near-term volatility could well persist, the bullish outlook remains solid here over the coming months.

Technical Views

BTC

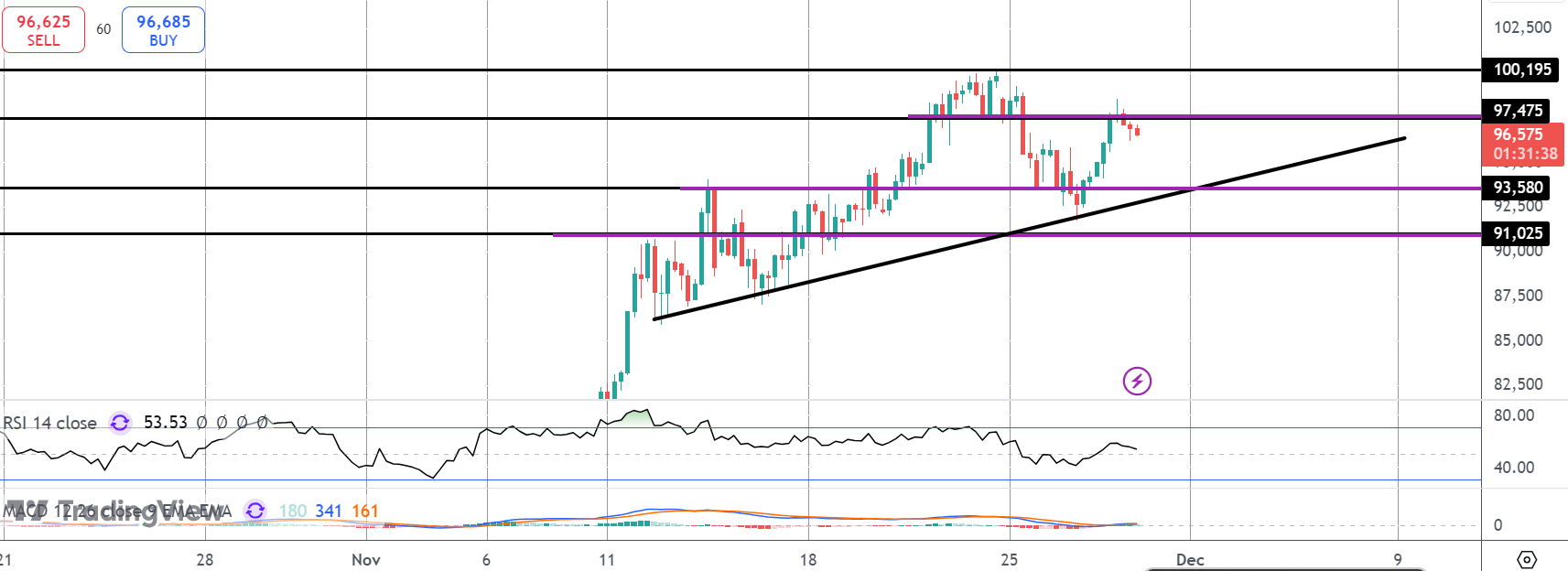

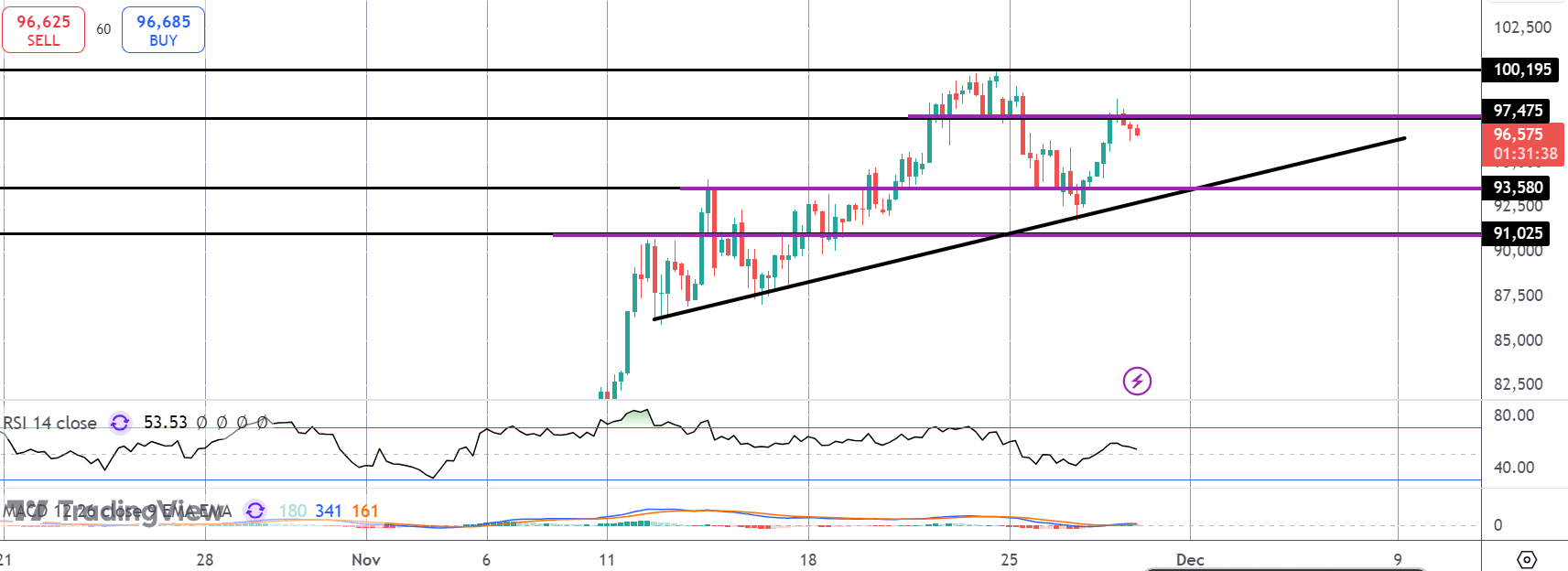

The recovery rally in BTC has stalled for now into the 97,475 level. With momentum studies weaker, a fresh downside push can materialise while we hold below this level. Bulls will need to defend the 83,580 area and the bull trend line to keep broader focus on a return to highs near-term.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.