BTC Trying to Push Higher

Bitcoin prices spiked higher today before running into selling pressure as the Futures market closed the gap with the Friday March 7th closing price. The market was initially higher in response to the FOMC yesterday with the Fed lowering its dot plot forecast to two expected rate cuts this year, down from just one prior. However, as traders have digested the details of the meeting through early European trading on Thursday, it seems that the upward revision to inflation forecasts is causing some concern.

Hawkish Fed Risks

The Fed noted that inflation was now expected to rise rapidly this year, as a result of the US trade war, though the lift is expected to prove transitory. Seemingly traders are not buying into this perspective, however, with USD rallying firmly this morning. The market is no doubt aware of the risks that inflation runs hotter than expected similar to what we saw early last year when the Fed was expected to cut but ended up being delayed through rampant inflation.

Near-Term Focus

Near-term, the focus is likely to stick with the Fed and USD for now. If the current USD rally gathers pace, this could create fresh headwinds for Bitcoin which is still currently in a downtrend and vulnerable to a fresh push lower. Ultimately, what bulls need now is some fresh, position contribution from the administration or a major breakthrough for risk sentiment, such as full and adhered to ceasefire between Russia and the Ukraine. Unless we get any bullish crypto news from the White House, or pro-risk geopolitical developments, BTC remains vulnerable if USD starts to push higher here.

Technical Views

BTC

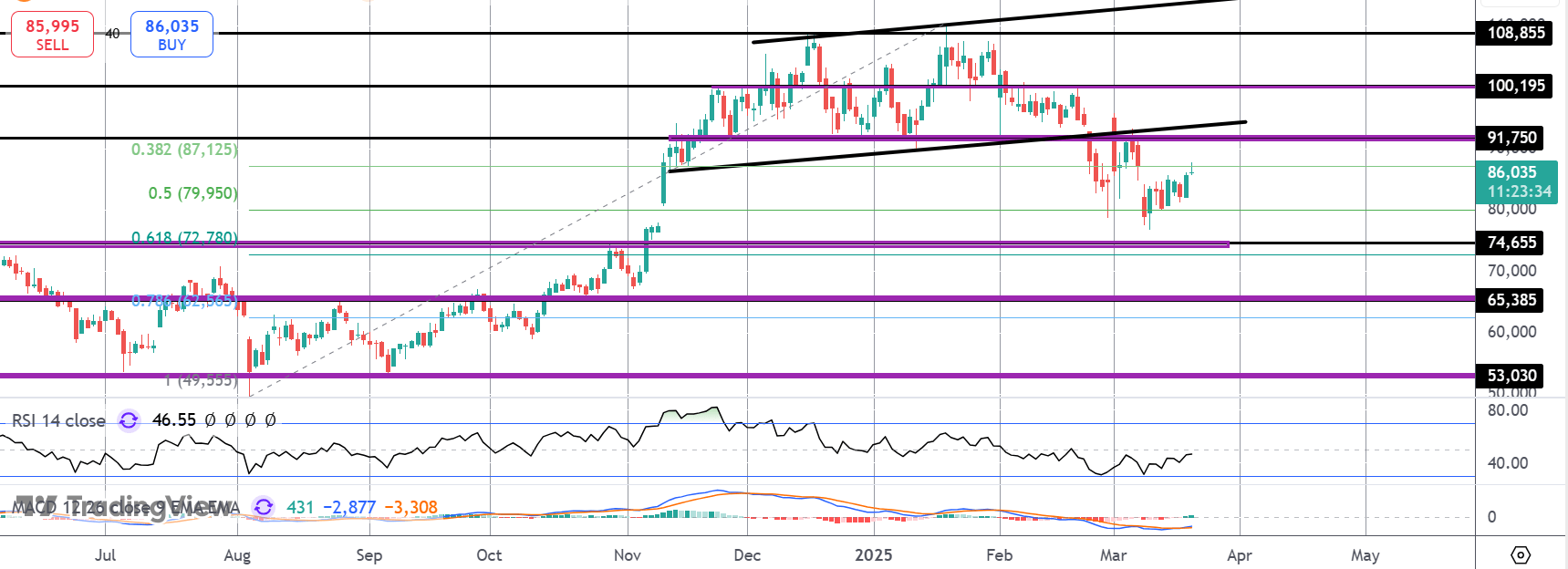

The sell off in BTC has stalled for now with a second failure at the 50% Fib retracement, creating the potential for a double bottom. Price is pushing higher but is currently capped at the retest of the broken 38.2% Fib level. Above, there is further resistance with the 91,750 level and retest of the broken bull channel lows. This is a key pivot for the market with a break higher seen turning focus back to YTD highs while failure at this level could spark a fresh leg lower.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.