Bitcoin Recovery Move Losing Steam

BTC Offered on Tuesday

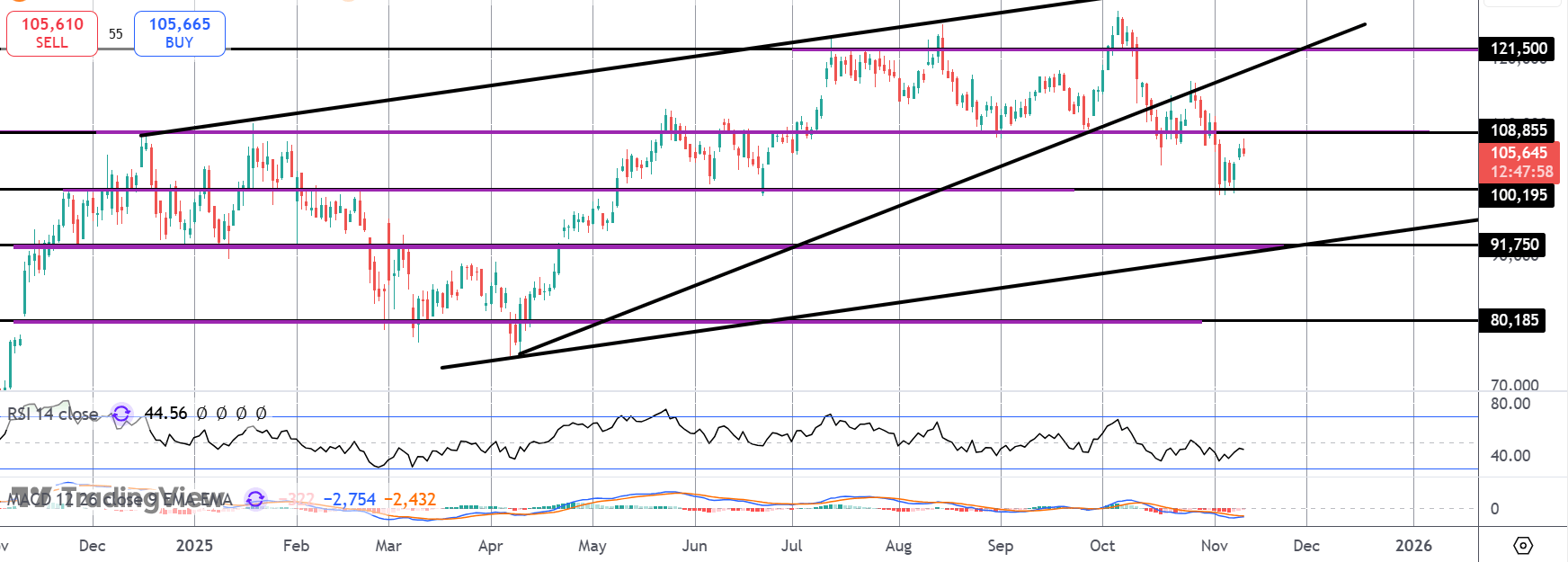

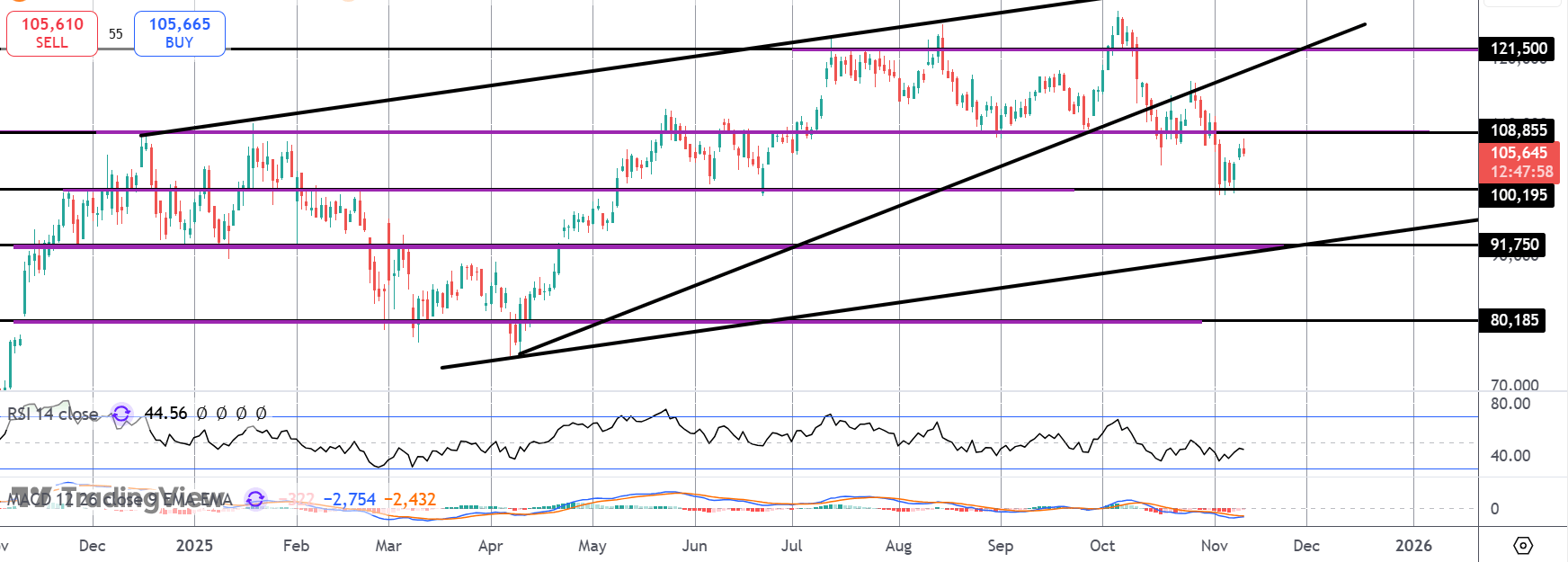

The fate of bitcoin continues to hand in the balance this week. Following a heavy reversal lower from the record highs printed in October, the market has found support at the $100k level with price subsequently bouncing. The recovery looks to be running out of steam, however, with fresh selling pressure kicking in ahead of the $108,855 level. While price remains capped by that level, we are at risk of seeing a fresh downturn and a break below $100k which could spell disaster for BTC near-term.

Fed Uncertainty

On the macro front, the trade deal announcement between the US and China has failed to revive BTC bullishness as uncertainty around the Fed outlook persists. While the market is still looking for a December cut, at 65% (CME FedWatch), down from 95% pre-FOMC, doubt has clearly set in. Much of this is due to the Fed’s own admission over the uncertainty it’s battling given the lack of data as the US govt shutdown rolls on.

Shutdown End in Sight

Over the weekend, discussions between senators resulted in a compromise bill passing a Senate vote, bringing the end of the shutdown one step closer. The bill will now need to pass a vote in the House, expected in the coming days. With expectations now that the govt will reopen soon, focus will turn to the delayed data with two sets of NFP readings, due, CPI, GDP and other key indicators from the last two months. If this data serves to revive Fed easing expectations, this should help lift risk assets and return BTC to highs. If data causes a furtehr weakening of dovish forecasts, however, BTC could move sharply lower.

Technical Views

BTC

While BTC remains below the $108,855 level, risks are skewed towards a fresh break lower and a test of the $91,750 level and bull channel lows. That is the pivotal area that bulls will need to defend. If held, a rotation higher within the channel can still be seen. Alternatively, if we break back above $18,855, near-term focus will turn to the YTD highs again.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.