BTC Volatility Kicks In

Following the historic break above the $100k mark earlier this week, Bitcoin prices are trading back below the level today after meeting strong selling interest at highs. BTC futures reversed sharply from highs around the $105 level and are now trading around the mid $98s. We noted earlier in the week that volatility is to be expected near-term given the profit taking likely to kick in on a break of $100k and year-end flows starting to materialise. However, the broader outlook remains firmly bullish for BTC with further advances likely in coming weeks and into next year.

Trump Trade

Optimism ahead of Trump taking office again in January has seen Bitcoin institutional demand soaring in recent weeks. With investors anticipating a much easier regulatory environment for crypto business, BTC is widely forecast to rally firmly over the start of next year. The uptick in institutional demand for BTC ETFs and BTC call options reflects this bullish outlook. While this dynamic remains in place, any dips look likely to find strong buying interest from bigger players and longer-term holder. Indeed, news that MicroStrategy has continued to make record BTC purchases in recent weeks is a good indication of the growing demand for BTC as an institutional play.

Technical Views

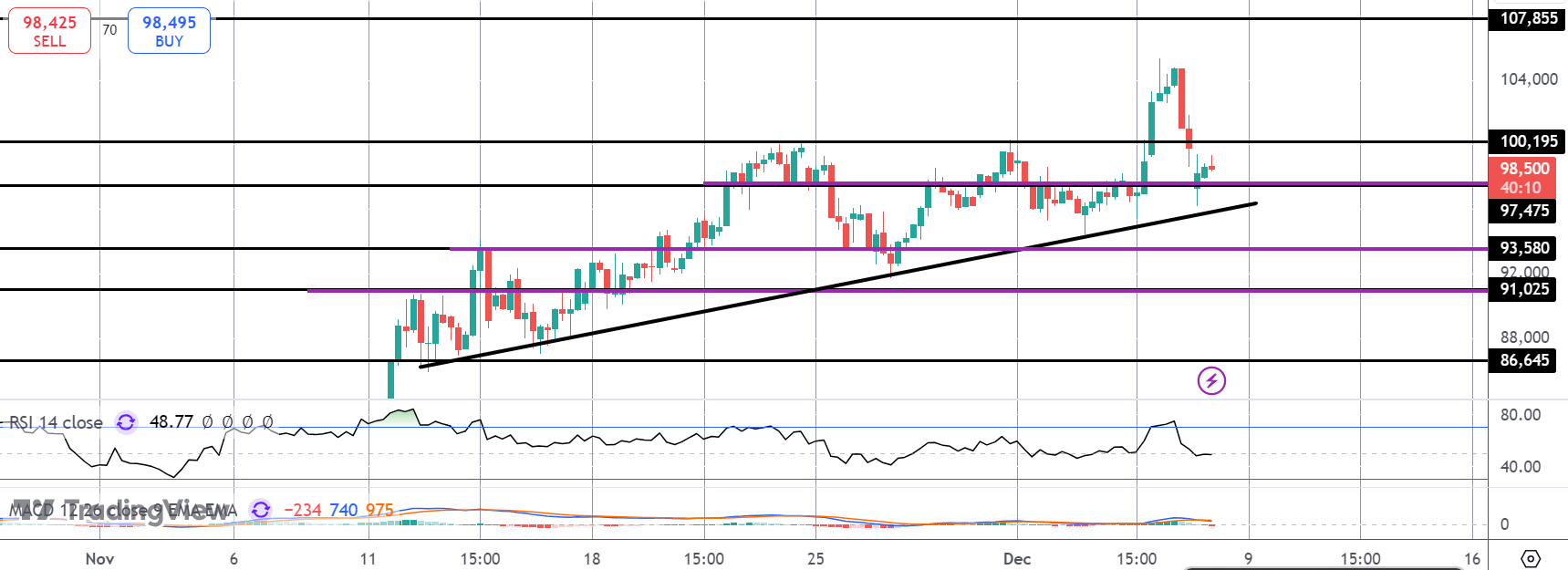

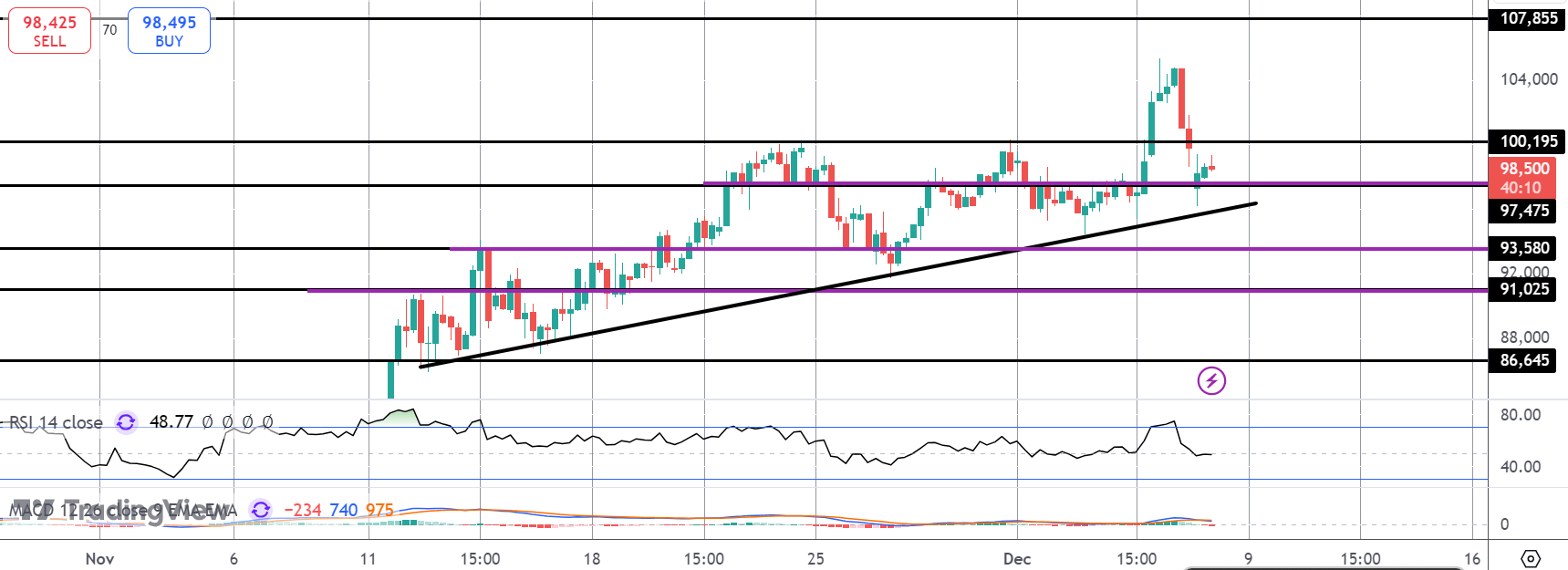

BTC

The rally in BTC has stalled for now into the $105 level with price since reversing back below the $100 mark and the prior 2024 highs. However, while still above 97,47 and the bull trend line, focus is on a continued move higher. Below there, however, focus turns to 93,58 as next support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.