Bitcoin Rallying on Monday

Bitcoin prices are seeing better demand on Monday with the futures market having now clawed back around half of the losses suffered on Friday. Price action has been muted in recent sessions though has been drifting lower, with the market still below the key $100k mark for now. Rising global uncertainty linked to Trump’s trade tariff announcements and other news flows have weighed on Bitcoin recently. Additionally, the absence of any pro-crypto moved from Trump has left bulls empty handed, leading to the move lower we’ve seen from the YTD highs.

Mainstream Demand Growing

Despite the pullback from highs, interest in Bitcoin remains elevated. News that an increasing number of corporates have been buying into Bitcoin via ETFs is a bullish sign for the market. Institutional demand has been a key supporting factor for Bitcoin this year with smart money still anticipating a rally over the year ahead despite current downside volatility. Indeed, there has also been reports of US endowments such as Universities and charities buying into Bitcoin alongside some pension funds, again reflecting the growing mainstream demand for crypto.

US Bitcoin Reserve

Much of this demand is hinged on the view that Trump will make good on his promise to make the US a ‘crypto superpower.’ Specifically, bulls are waiting on news linked to the creation of a US strategic Bitcoin reserve which is seen as the ultimate bullish catalyst. Any news flow regarding steps towards this will be firmly bullish for BTC. Meanwhile, the longer w ego without anything pro-crypto from Trump, the lower we are likely to drift.

Technical Views

BTC

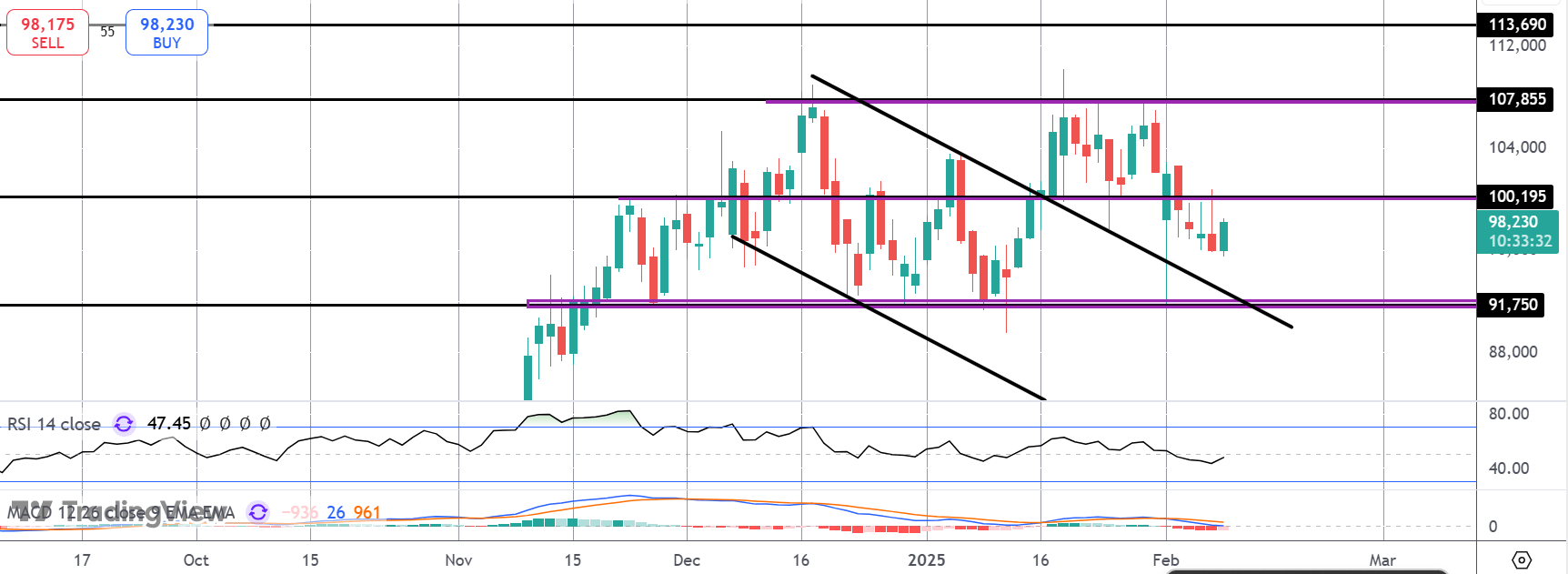

For now, price continues to trade within the 91,750 – 107,855 range. A possible double top formation is still in play given the latest failure at range highs and any downside break of the 91,750 level will be firmly bearish, opening the way for a much deeper push lower. To the topside, if bulls can get back above the 100k mark, focus will turn back to range highs and the 113,690 level above.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.