BTC Higher Ahead Of US Jobs Data

Bitcoin Rising On USD Drivers

Bitcoin futures are trading higher today ahead of the US jobs number. A combination of a weaker Dollar and bolstered risk sentiment attached to dovish Fed expectations and the passing of the debt ceiling bill are helping underpin crypto currently. However, there are two-way risks into today’s US labour market data. Yesterday’s ADP employment change number was seen coming in well above forecasts at 278k vs 173k expected. While the strength of the correlation varies, the ADP number has often been used as a gauge for the NFP. If we see a similar upside beat in the NFP today, that might once again muddy the view ahead of the June meeting.

NFP Up Next

Looking at the numbers for today’s data then. The NFP is forecast at 193k down from 253k prior while the unemployment rate is pegged to rise to 3.5% from 3.4% prior. Finally, wages are set to cool to 0.3% from 0.5% prior. If seen, this set of data should support the view that the Fed will hold rates steady in June, allowing crypto and other risk assets room to move higher. It would likely take a strong upside beat on the NFP and wages to alter this view now on the back of recent Fed comments.

Technical Views

BTC

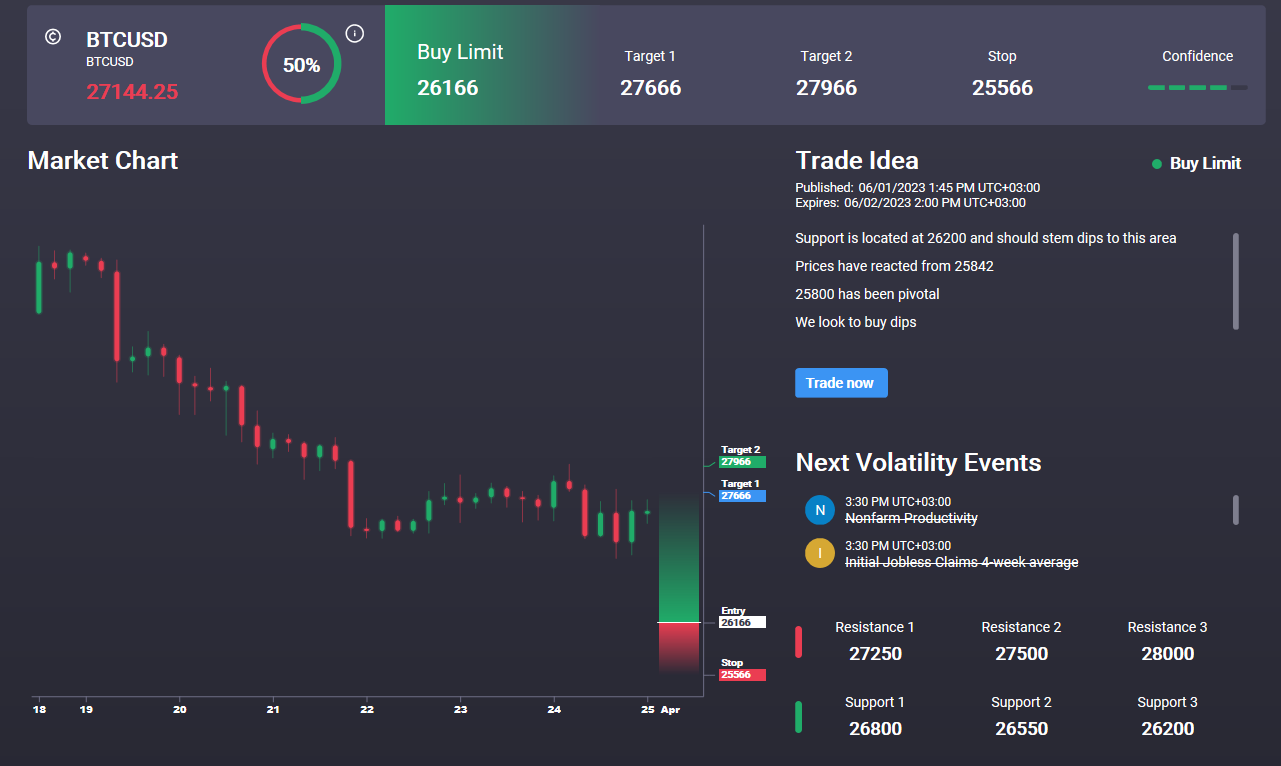

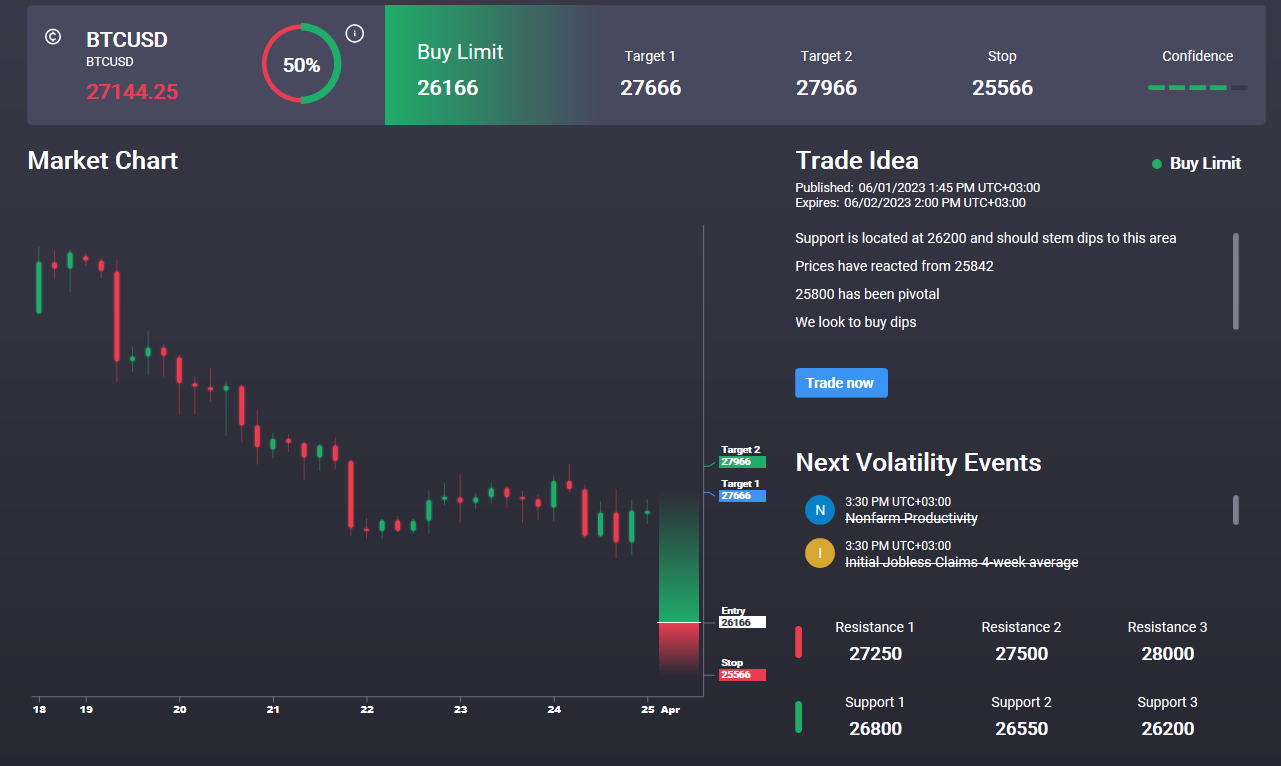

For now, BTC is holding just below the broken triangle bottom and 27415 level support. Bulls need to get back above here to encourage fresh momentum for a push back towards the 32185 level. While below here, risks grow of a deeper drop towards the 24930 level support next. Interestingly we also have a bullish signal in the Signal Centre today from 26166 projecting a level of strong demand from that point should price dip lower from here.

.png)

Signal Centre is a proprietary trading-signal suite offered to all Tickmill traders. Signal Centre combines human and AI driven analysis to offer traders actionable entry and exit points that they can use for their trading strategies. Signals are offered across a range of asset classes including Forex, Stocks, Commodities and Crypto.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.