Bitcoin Bounces off Lows

Bitcoin prices look to be staging a tentative recovery today following a sharp sell-off yesterday. Bitcoin futures fell to their lowest levels since early January as ETF outflows and long liquidations rose in response to hawkish Fed commentary this week. With the growing view that US rates will now stay higher for longer, Bitcoin has suffered a drop in bullish sentiment recently. BTC fluctuations have grown more closely linked to Fed rate expectations over the last year and the introduction of institutional access to the market this year has reinforced this dynamic. Consequently, a sharp rise in ETF outflows in recent weeks is continuing to weigh on BTC.

Crypto Market Developments

Away from US rate projections, BTC yesterday responded to more crypto-centric factors. News that the eurozone intends to prohibit unlicensed stable-coins by March 2025 raised fears of a liquidity issue in the broader crypto market. Additionally, a crash in the Argentinian crypto market amplified the sense of uncertainty among crypto investors yesterday, particularly retail traders.

Bulls Waiting on Trump

The bounce in BTC off the lows, with BTC futures gapping higher today, show that there is still a base layer of demand in the market. Near-term, risks remain skewed towards further downside. However, any crypto-positive news from Trump would be firmly bullish and likely catch the market a little off-guard at this point. Without any news or moves from Trump, however, the current lull looks likely to extend for now.

Technical Views

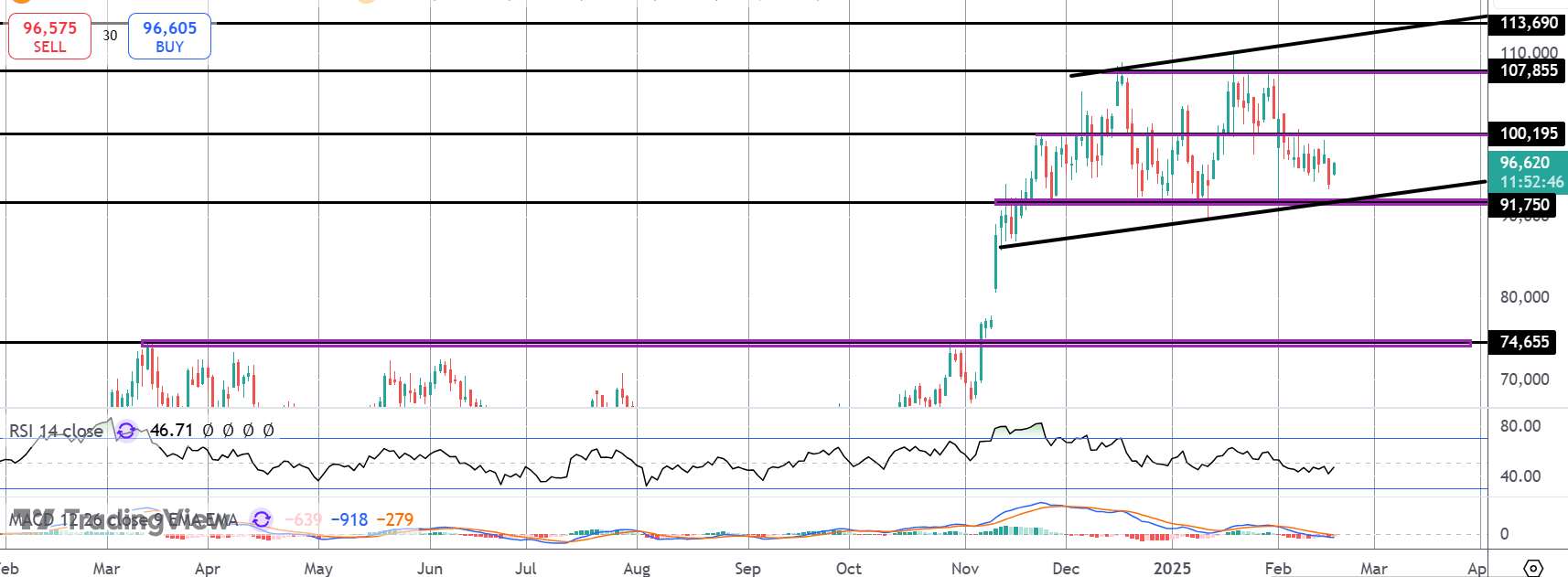

BTC

For now, the market continues to drift towards a fresh test of the 91,750 range lows. This area has underpinned the market since Q4 and is expected to hold, extending the current range-bound conditions. A break below will be firmly bearish for the market, opening up a return to the 74,655 level. While this level holds, however, focus is on an eventual upside resolution though this could be months down the line from here.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.