Crude Below Major Level As US Demand Plunges

Oil Selling Pauses…For Now

Oil prices have paused in their recent decline today, though remain weak on the back of the heavy selling we’ve seen over the last ten days. Some softening in the trade war landscape has helped stem the sell-off for now, while the impact of a heavily lower US Dollar is also sure to be helping. However, the near-term outlook remains precarious with OPEC+ expected to increase output next month, the prospect of an end to the Russia-Ukraine war (reduced supply risks, return of Russian crude to wider market) and the ongoing tensions between the US and China.

Fresh EIA Inventories Surplus

Yesterday, the EIA reported a further crude inventories build in the US with stockpiles seen rising by almost 4 million barrels. The surplus marks the fifth week of inventories increases in the last six and reflects much weaker demand in the US. Looking ahead this week, traders will be closely watching tomorrow’s US labour market data. Fears that Trump’s trade war could send the US into recession mean that traders are highly sensitive to incoming US data. For crude, the reaction function is a little more mixed given that weaker US data certainly has negative implications for the crude demand outlook but also fuels stronger selling in USD which should offset some of the selling in crude.

Technical Views

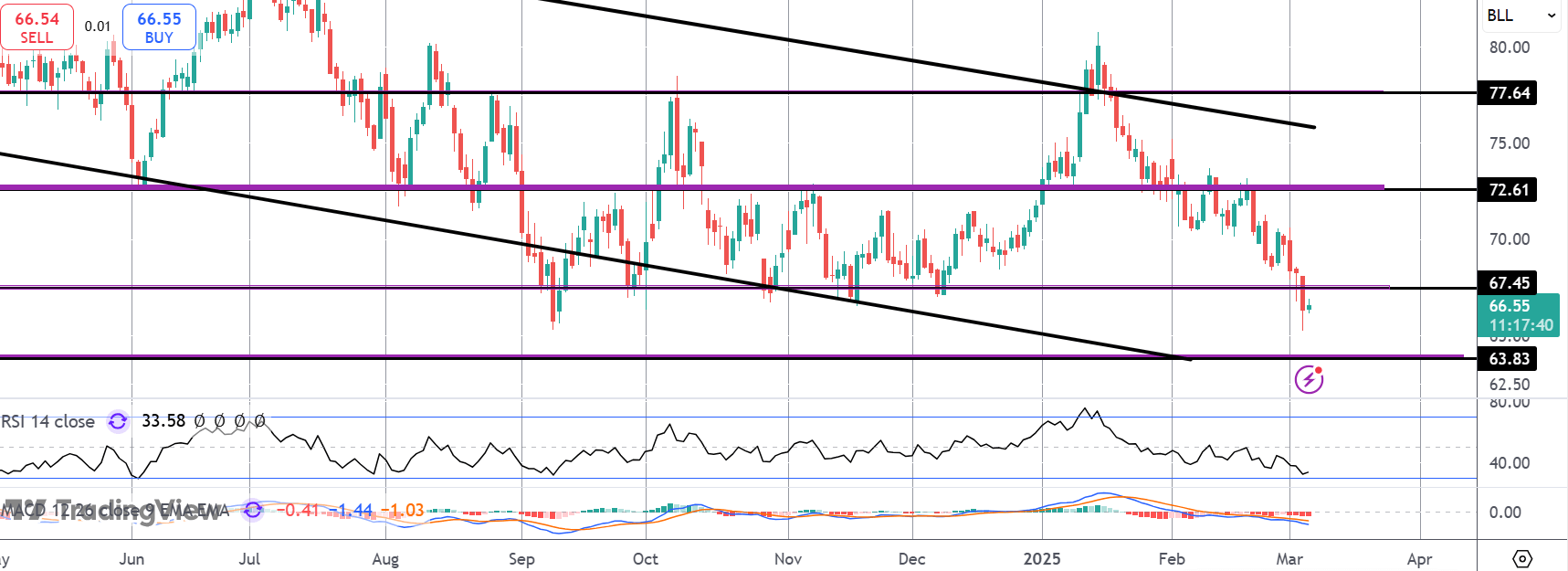

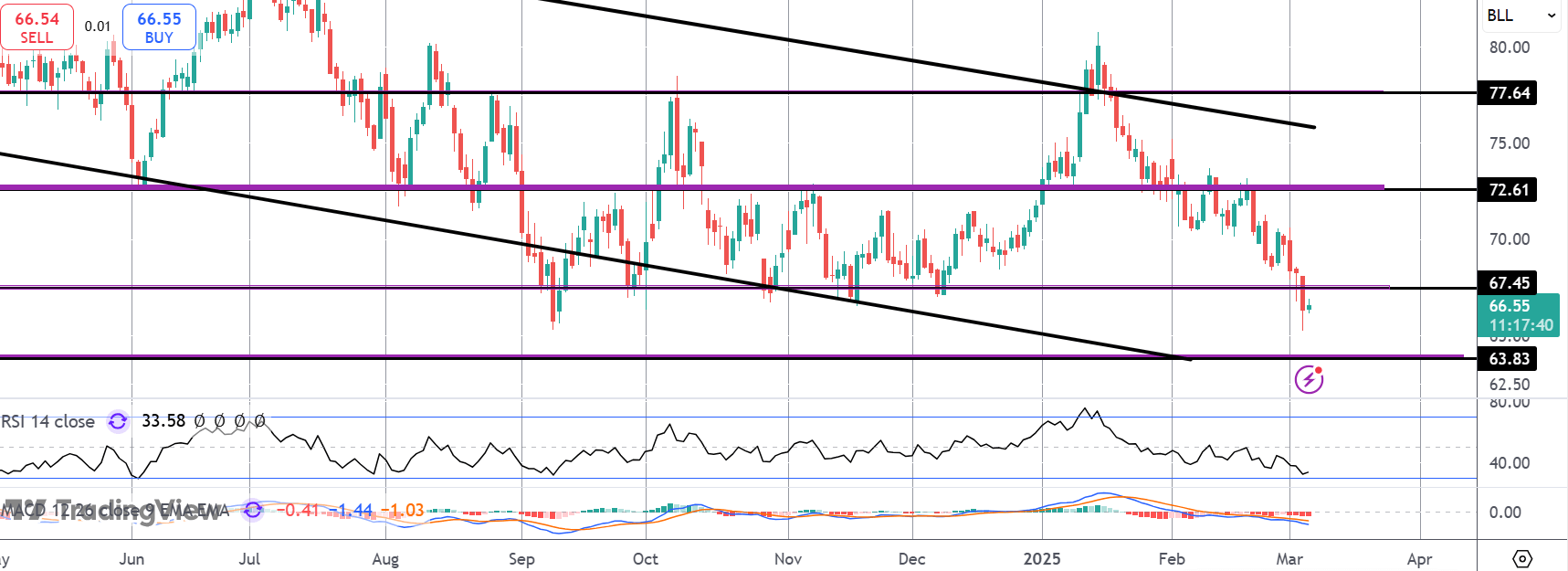

Crude

The sell off in crude has seen the market breaking down below the 67.45 level where price is currently stalled. This is a major multi-year support level with risks pointed towards a deeper move lower while price holds below the level. If bulls can get back above, 72.61 will the first objective.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.