Daily Commodity Outlook, May 19 2020

Asian stocks surged on Tuesday, following a strong rally on Wall Street, after early results for an experimental vaccine sparked speculation economies could snap back quickly. Oil extended gains and Treasury yields held near five-week highs. Federal Reserve Chairman Jerome Powell is scheduled to speak on the state of the recovery Tuesday, amid expectations, he’ll press for further fiscal support.

USD is weakening upon the risk-on sentiment triggered by Moderna’s vaccine optimism. Investors are excited the vaccine was able to elicit an antibody response at just two weeks post-dose.Moderna is now seen having a 75% chance of success, whereas Goldman had previously modelled 70% odds. If Moderna is to succeed in launching its vaccine, USD could drift away from recent safe haven peaks and open up a bigger space for the downside.

Copper prices climbed to a two-month high as moves by many countries to ease restrictions, along with Moderna Inc’s experimental Coronavirus vaccine lifted the market’s risk appetite. The three-month copper on the London Metal Exchange (LME) rose as much as 1.1% to $5,377.50 a tonne, its highest since March 16 while the most-traded copper contract on the Shanghai Futures Exchange advanced 2% to 43,770 yuan ($6,157.33) a tonne.

Gold has risen about 14% this year as central banks rolled out a wave of interest rate cuts and other stimulus to limit the economic damage as a result of the Covid-19 pandemic. Meanwhile, demand for the metal is likely to climb higher as the lower interest rates reduce the opportunity cost of holding non-yielding bullion.

Oil prices advanced further after early results for an experimental vaccine sparked renewed speculation that economies could recover quickly. Further recovering demand coupled with production cuts brightened the outlook for energy prices. However, oil experts caution about being too optimistic as markets could very well be running ahead of facts thinking economies could now be on track to recovery. The CAD strengthened greatly overnight in line with oil prices. Further, with the weakening of the USD, we see the USDCAD completely reversing direction and dropping much lower, nearly erasing all the gains it made last week.

Technical & Trade views

USDCAD (Intraday bias: bullish above 1.3902)

We turned bullish as price is approaching our first support in line with our 161.8% fibonacci extension where we are expecting a further bounce to our first resistance level, in line with our horizontal pullback high resistance. Stochastic is approaching support as well.

UKOIL (Intraday bias: Bullish above 33.86)

Oil prices pushed higher surpassing previous resistances. Price is currently in wave 5 configuration of Elliot Wave theory. With price holding above moving average and MACD above 0, in bullish territory, we expect price to make a further push up above 1st support towards 1st resistance at 38.88

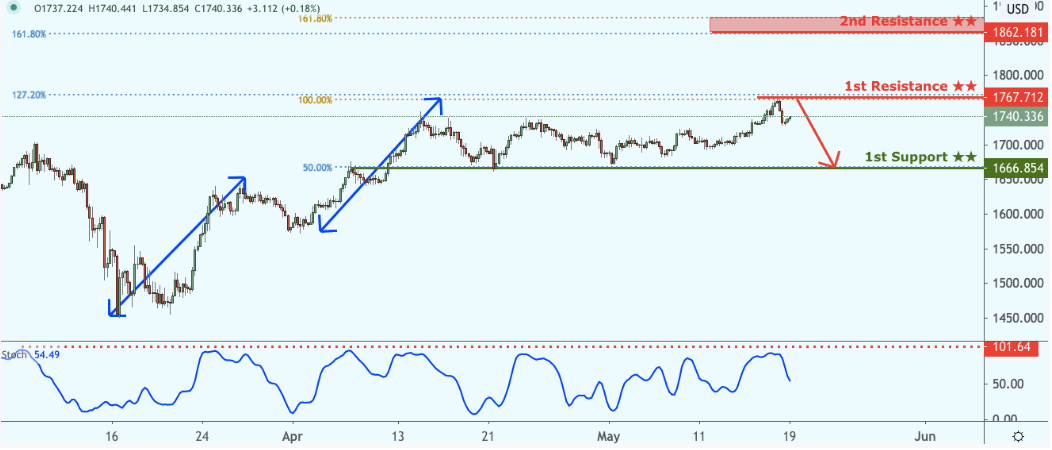

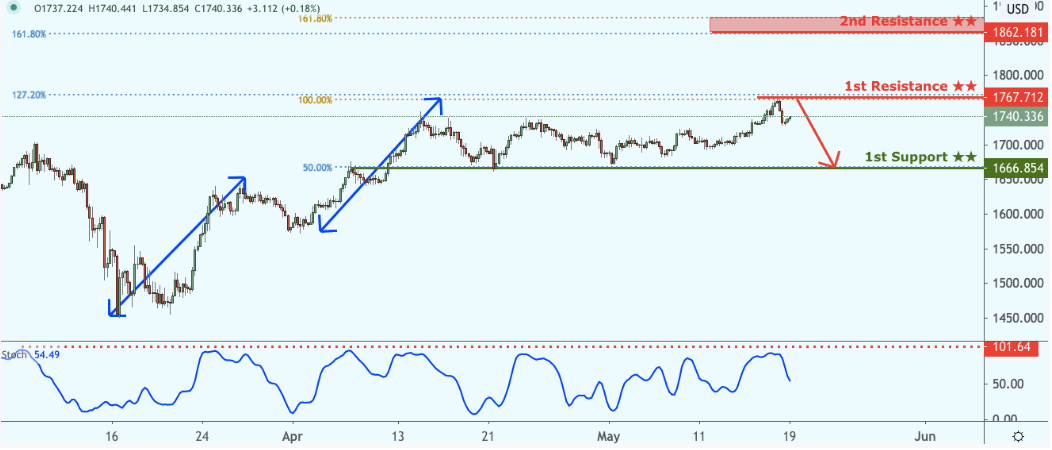

XAUUSD ( Intraday bias: bearish below 1767.712)

Price is approaching our first resistance, in line with our 127.2% fibonacci retracement and 100% fibonacci extension where we could see a drop to our first support level. Stochastic is approaching resistance as well where we might see a reversal below this level.

XCUUSD ( Intraday bias: bullish above 2.42679)

Price is testing our resistance where a break above this level would provide the bullish acceleration to our first resistance level, in line with our 61.8% fibonacci retracement and horizontal swing high resistance. Ichimoku cloud is also showing signs of bullish pressure in line with our bullish bias.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Desmond Leong runs an award-winning research firm (The Technical Analyst finalists 2018/19/20 for Best FX and Equity Research) advising banks, brokers and hedge funds. Backed by a team of CFA, CMT, CFTe accredited traders, he takes on the market daily using a combination of technical and fundamental analysis.