Daily Market Outlook, April 8, 2024

Munnelly’s Macro Minute…

“US CPI & The ECB The Main Macro Drivers Ahead”

Most Asian stock markets are experiencing gains on Monday, in line with the generally positive signals from global markets last Friday. This comes as traders respond to US data indicating a significantly stronger job growth in March than expected, signaling a healthy economy. The Japanese stock market is experiencing a significant increase, recovering from some of the losses from the previous session. The Nikkei benchmark has surpassed the 39.5K handle, influenced by positive trends in global markets on Friday. This has resulted in gains across various sectors, particularly driven by leading companies, exporters, and technology stocks.

Today's economic data docket remains light, with key data and events scheduled later in the week. These include Wednesday's US CPI inflation report, projected to show a slight decrease in core inflation but an increase in overall inflation due to elevated oil prices, posing challenges for the Fed's interest rate decision. On the same day, the European Central Bank might use its April update to lay the groundwork for a June interest rate cut. Additionally, Friday brings the latest monthly UK GDP data and a report on Bank of England forecasting by former Fed Chair Ben Bernanke.

The latest UK jobs report by S&P Global, KPMG, and REC, released earlier today, indicates a further relaxation in labor market pressures. New recruit wages saw their slowest growth in three years, attributed to increased workforce availability and businesses scaling back hiring. With ongoing uncertainty surrounding official labor market data, this report garners significant attention, seemingly aligning with Bank of England Governor Bailey's recent suggestion that inflation risks from labor markets may be diminishing. However, it does not reflect the impact of this month's national living wage increase. BoE MPC member Breeden is scheduled to speak today at an event in Zurich, focusing on the future of the monetary system. It is unlikely that her remarks will touch upon interest rate policy.

In the Eurozone, the only noteworthy release today is the April update for the Eurozone Sentix investor confidence index, which has been on the rise for five consecutive months, reflecting market recovery and optimism regarding potential interest rate cuts. However, its level remains relatively low compared to historical standards.

Stateside, attention is on the New York Fed's inflation expectations index, monitoring any impact from recent oil price hikes. Inflation expectations, though significantly lower compared to the past year, still exceed pre-COVID levels. The New York Fed index, focusing on one-year inflation expectations, tends to fluctuate due to gasoline price shifts and may see a rebound in today's reading.

Overnight Newswire Updates of Note

China’s Economy To Grow 5.3% This Year As Property Sector Stabilizes

BoJ Gov Ueda: Will Respond Appropriately To Changes In The Economy

PBoC To Give $69 Billion In Loans To Boost Science, Technology

Yellen, China’s He Agree To Talks Aimed At ‘Balanced Growth’

ECB Jostling Over Back-To-Back Summer Cuts Has Already Begun

Italy Sees Debt ‘Surely’ Staying Below 140% Of GDP This Year

Japanese Yen Hangs Near Multi-Decade Low Against USD

Bond Traders See 4.5% Yields As Next Test As Focus Shifts To CPI

Oil Slides More Than 1% As Middle East Tensions Ease

Netanyahu Says Victory Near, Pulls Some Troops From Gaza

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.750 (1.1BLN), 1.0790-1.0800 (1.3BLN), 1.0830-40 (542M)

1.0880 (401M), 1.0930 (402M)

GBP/USD: 1.2500 (380M), 1.2630 (476M)

EUR/GBP: 0.8580 (350M), 0.8705-10 (675M)

AUD/USD: 0.6580 (371M). AUD/NZD: 1.0900 (266M), 1.1000 (309M)

USD/CAD: 1.3600 (262M)

USD/JPY: 151.00 (362M), 151.45-55 (400M), 151.85 (748M)

152.00 (216M), 152.50 (439M)

CFTC Data As Of 29/03/24

Bitcoin net long position is 160 contracts

Swiss Franc posts net short position of -22,370 contracts

British Pound net long position is 43,414 contracts

Euro net long position is 16,794 contracts

Japanese Yen net short position is -143,230 contracts

Equity fund managers cut S&P 500 CME net long position by 26,140 contracts to 930,132

Equity fund speculators trim S&P 500 CME net short position by 83,217 contracts to 365,684

Technical & Trade Views

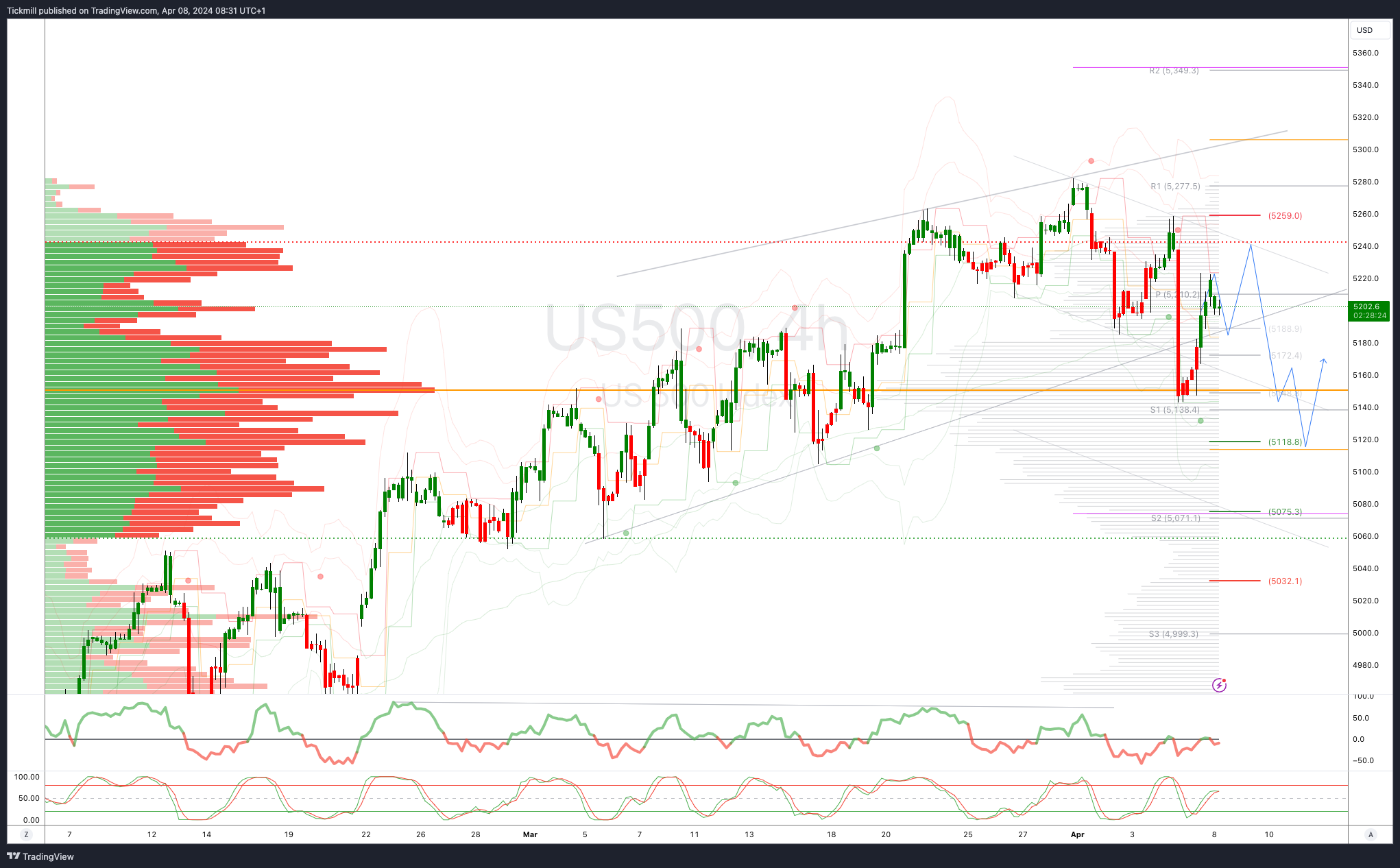

SP500 Bullish Above Bearish Below 5230

Daily VWAP bullish

Weekly VWAP bullish

Below 5140 opens 51180

Primary resistance 5230

Primary objective is 5118

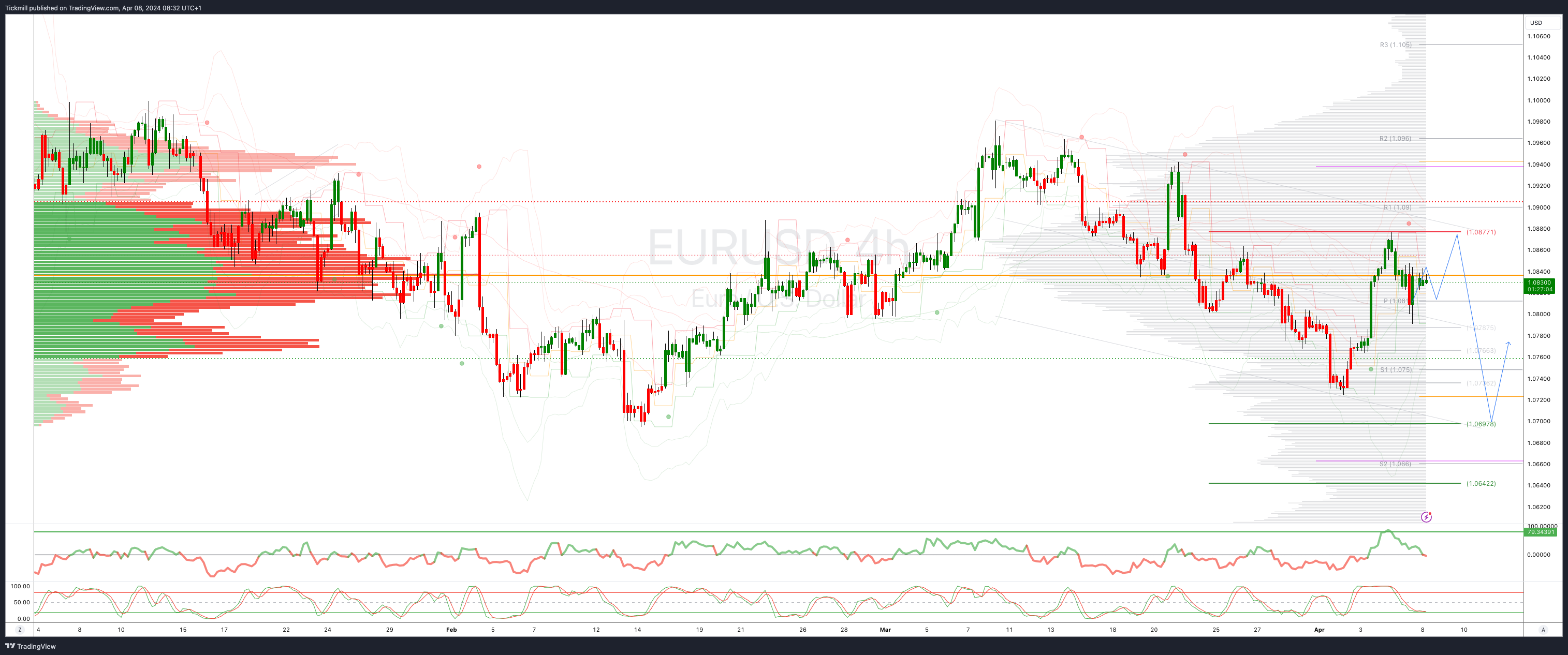

EURUSD Bullish Above Bearish Below 1.0877

Daily VWAP bearish

Weekly VWAP bearish

Below 1.0690 opens 1.0630

Primary support 1.0690

Primary objective is 1.0685

GBPUSD Bullish Above Bearish Below 1.27

Daily VWAP bullish

Weekly VWAP bearish

Below 1.2570 opens 1.2510

Primary support is 1.2500

Primary objective 1.29

USDJPY Bullish Above Bearish Below 150.25

Daily VWAP bullish

Weekly VWAP bullish

Above 151 opens 152

Primary support 145.85

Primary objective is 153

AUDUSD Bullish Above Bearish Below .6570

Daily VWAP bullish

Weekly VWAP bearish

Below .6460 opens .6420

Primary support .6477

Primary objective is .6700

BTCUSD Bullish Above Bearish below 68000

Daily VWAP bearish

Weekly VWAP bullish

Below 64000 opens 59588

Primary support is 52800

Primary objective is 78000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!