FOMC in Focus

The US Dollar is on watch today as traders brace for the latest FOMC meeting this evening. It’s widely expected that the FOMC will keep rates where they are so the bigger focus will be on the updated dot plot projections. As of the last update, the Fed forecasts a 50-basis point rate cut by year-end. However, in light of recent developments there’s a chance they could dial it back to just 25-basis points, putting USD at risk of higher prices if they do scale back easing forecasts.

Oil Prices on Watch

The recent spike in oil prices might undo some of the good news we've seen on inflation lately, especially since the Fed is still worried about price hikes from tariffs in the months ahead. If oil prices continue to push higher in coming weeks, this could cause a big shift across the central bank space putting fresh, upward pressure on inflation. In this scenario, USD should find higher ground as traders scale back their Fed rate-cut expectations accordingly.

Middle East Headlines

Alongside the Fed, the market will be closely monitoring incoming headlines around the Israel-Iran war, particularly given the chatter around possible US involvement. USD has shifted in the last 24 hrs, finding a safe-haven bid in response to these reports. As such, if the conflict does escalate, particularly if the US intervenes, USD looks poised to rally further on increases safe-haven demand. Additionally, a continued spike in oil prices should further dampen near-term Fed easing expectations, creating stronger support for USD near-term.

Technical Views

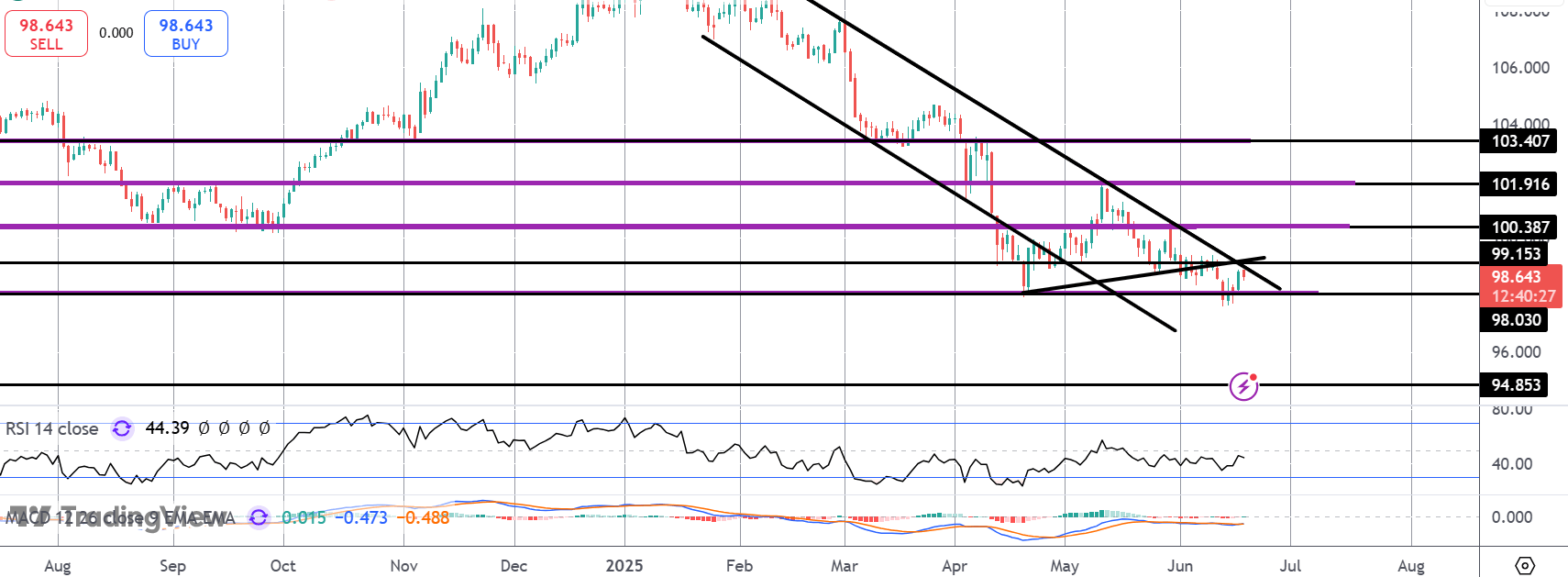

DXY

For now, support around the $98 level is holding. Price is now testing the bear channel highs and the $99.15 level resistance as well as retesting the broken bull trend line from YTD lows. This is a key pivot which, if broken, opens the way for a fresh push higher back towards the $100 mark

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.