GBPUSD Testing Support Ahead of BOE

BOE Up Next

Following on from the Fed yesterday, the BOE will step into centre stage today. Given the building speculation around anticipating the first 2024 central bank rate cuts, there is plenty of attention on today’s meeting and plenty of volatility risk consequently. Despite the recent uptick in UK inflation, which rose last month for the first time in 10 months, it seems the market is expecting a more dovish tone from today’s meeting. While no change in policy is expected, traders will be looking for signals that rate cuts are forthcoming, in line with current market projections for a June rate cut.

Dovish Expectations

The BOE has warned that it is still too early to declare victory on inflation and signalled last time around that it stands ready to tighten further if necessary. However, despite the uptick in consumer prices, the fall in services inflation and wage growth has seen many players backing calls for a summer rate-cut, setting the scene for today’s meeting. Traders will be looking to see if this message has softened at all, paving the way for a cut.

Voting Split in Focus

Given the expectation for no policy shift today, traders will be closely monitoring the voting split, along with the wording of the statement, meeting minutes and post-meeting presser. In terms of voting, last time around saw a 6-3 split (hold, hike) which is forecast to fall to 7-2 today. Should those voting in favour of a hike fall below 2 this would be seen as firmly dovish and should lead GBP lower near-term. The only real upside risks for GBP today are if the BOE stands firm on its inflation warning, pushing back against near-term rate calls and signalling that there is still more to do.

Technical Views

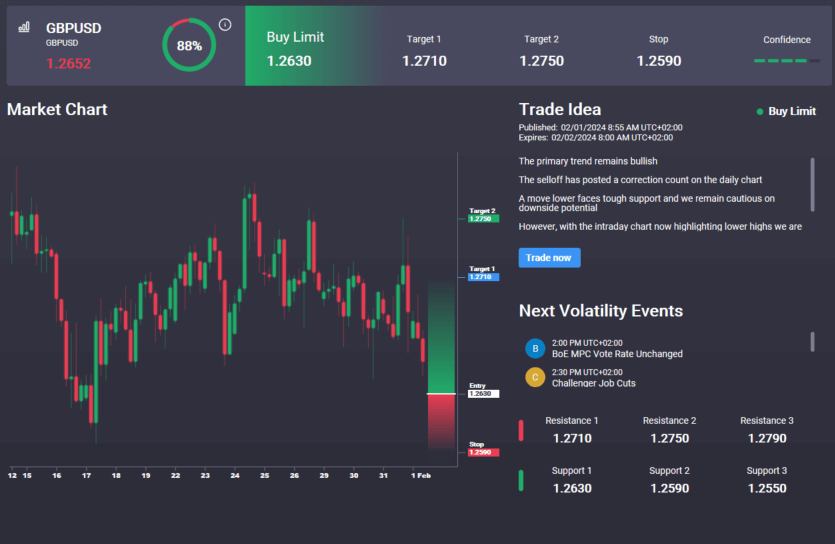

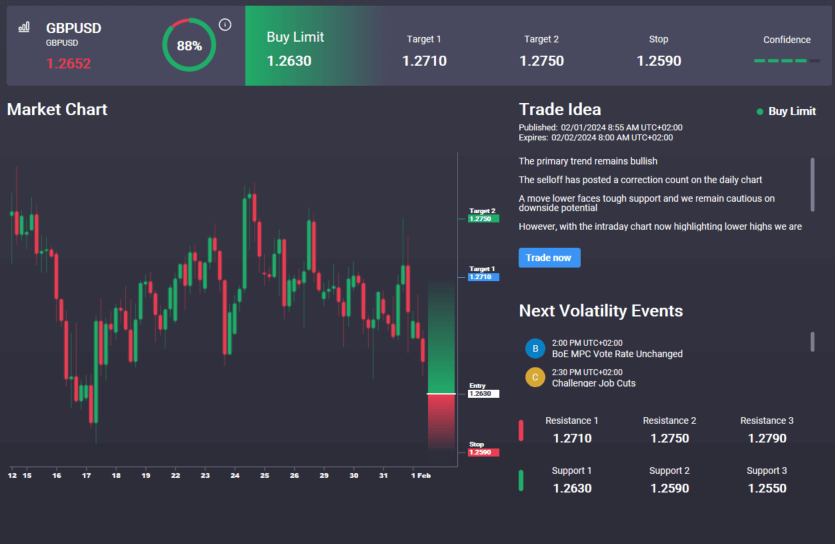

GBPUSD

For now, the pair remains above the 1.2612 support level which has underpinned price action since early December. With momentum studies weakening, risks of a downside break are growing with 1.2437 the next target for bears. To the topside, 1.2832 is the key level for bulls to clear. Interestingly, we have an active buy signal in the Signal Centre today set below market at 1.2630 for a run back up to range highs.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.