Institutional Insights: Credit Agricole FX Positioning Update

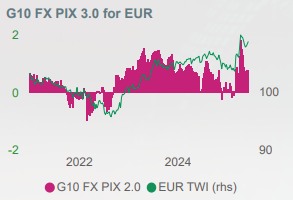

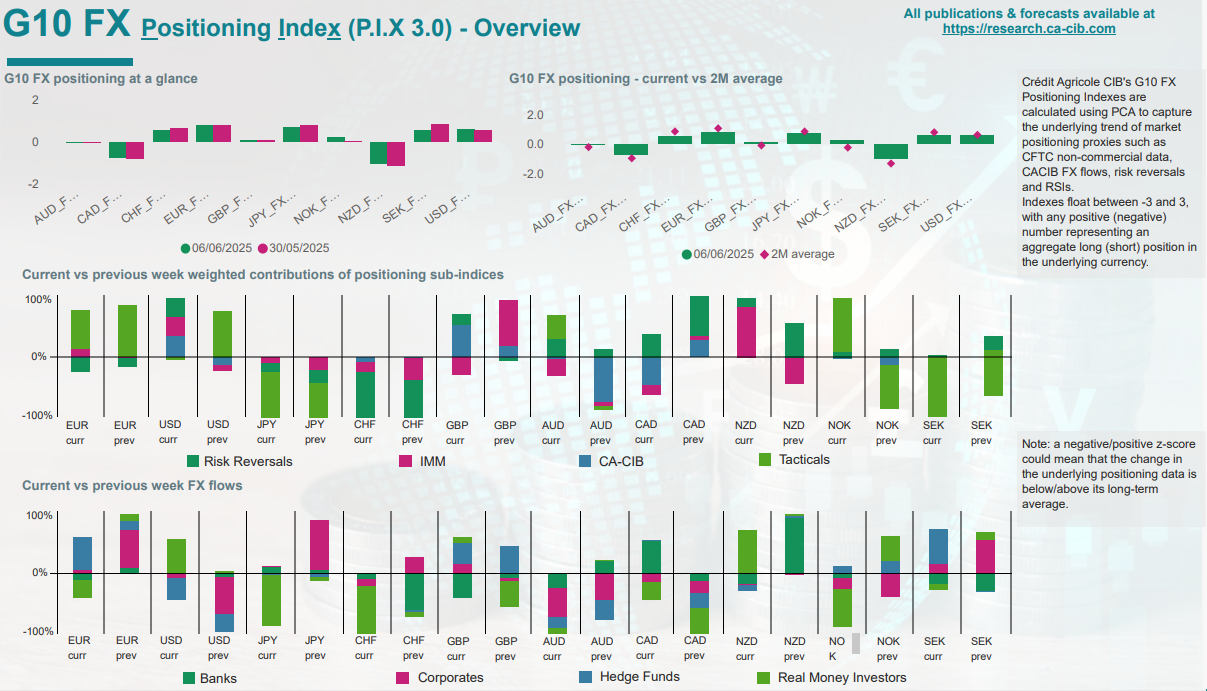

- The EUR emerged as the largest long in G10 FX last week, primarily driven by Tactical flows. FX flow data indicates inflows from corporates and hedge funds, while banks and real money investors showed outflows.

- The USD saw increased buying interest last week, largely influenced by Crédit Agricole CIB flows. FX flow data highlights inflows from real money investors, whereas banks, corporates, and hedge funds recorded outflows.

- The JPY experienced selling pressure last week, mainly driven by Tactical flows. FX flow data shows inflows from banks and corporates, with hedge funds and real money investors contributing to outflows.

- The CHF faced selling interest last week, predominantly driven by Risk Reversals flows. FX flow data points to inflows from hedge funds, while banks, corporates, and real money investors registered outflows.

- The GBP enjoyed buying interest last week, primarily supported by Crédit Agricole CIB flows. FX flow data reveals inflows from corporates, hedge funds, and real money investors, alongside outflows from banks.

- The CAD experienced buying interest last week, largely driven by Crédit Agricole CIB flows. FX flow data highlights inflows from banks and hedge funds, while corporates and real money investors showed outflows.

- The AUD attracted fresh buying interest last week, mainly due to Tactical flows. FX flow data indicates outflows from banks, corporates, hedge funds, and real money investors.

- The NZD remains the largest short in G10 FX despite some buying interest last week, driven by IMM flows. FX flow data shows inflows from real money investors, while banks, corporates, and hedge funds contributed to outflows. Overall, the NZD is no longer in overbought territory.

- The NOK saw renewed buying interest last week, predominantly driven by Tactical flows. FX flow data highlights inflows from hedge funds, with banks, corporates, and real money investors recording outflows.

- The SEK encountered selling pressure last week, primarily driven by Tactical flows. FX flow data reveals inflows from corporates and hedge funds, while banks and real money investors registered outflows.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!