Institutional Insights: Goldman Sachs - What to Watch When Deciding to Step In During This Event-Driven Sell-Off

.jpeg)

What to Watch When Deciding to Step In During This Event-Driven Sell-Off

FICC and Equities

Markets are awaiting a significant policy change, either from Trump (difficult to predict when or if it will happen) or Powell. A further widening of credit spreads and recessionary bond market pricing could trigger a shift in Federal Reserve policy, potentially leading to a turnaround in equity markets. However, we’re not at that point yet. Encouragingly, our Risk Appetite Indicator suggests brighter days may be ahead.

Key Metrics to Monitor:

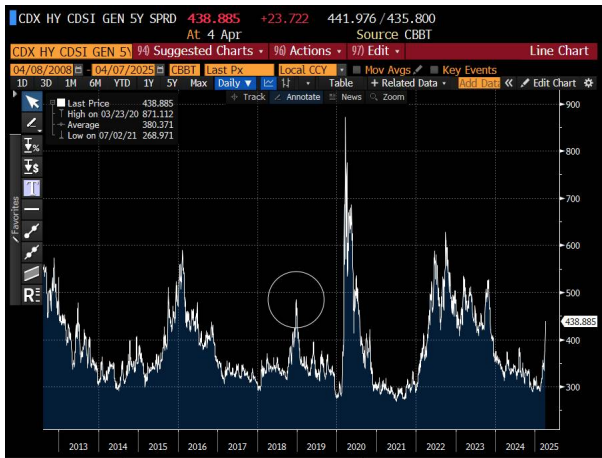

- Credit Spreads: Keep an eye on the CDX HY 500/550 level; we haven’t reached critical levels yet.

- Bond Market Pricing: Not displaying recessionary signals at this stage.

- Risk Appetite Indicator: Positive news—our indicator just hit -2 intraday. Historically, S&P 500 returns following levels below -2 have a hit ratio of over 90% for positive returns in the subsequent 12 months.

Credit Spreads: From Wall Street to Main Street

Credit spreads have only started reacting in the past few days, and Powell is closely monitoring them as they serve as a reliable gauge of economic stress transitioning from Wall Street to Main Street.

If credit spreads widen significantly, corporations may face challenges in securing financing, potentially leading to weakened job markets. Powell’s recent hawkish stance reflects his view that this sell-off is event-driven, with data remaining strong thus far. He appears reluctant to act prematurely, as tariffs could introduce inflationary pressures.

Bond Market Pricing - Not Recessionary Yet

Yields are trending lower, and curves are bull steepening as more rate cuts are being priced in the short term. However, the bond market's movements have remained relatively contained thus far.

For instance, bond markets are currently projecting a FED funds rate of 3% one year from now, which aligns with the FED's nominal neutral rate—hardly indicative of a recession. At present, five rate cuts are priced in for the next year, whereas recessionary scenarios typically involve pricing closer to 8-10 cuts.

Additionally, with only a 51% probability of a rate cut at the May meeting, the bond market still has significant adjustments to make before Powell potentially intervenes to shift policy. Such a shift could lead to a turnaround in equity markets.

A FED funds rate of 3% a year from now signals a non-recessionary outlook.

Our Risk Appetite Indicator – Good News: It just hit -2 intraday. Historically, the probability of positive S&P 500 returns over the subsequent 12 months from levels below -2 exceeds 90%.

Andrea Ferrario:

Overall, the recent 'risk-off' sentiment has been widespread across asset classes. Our Risk Appetite Indicator experienced one of its largest 2-day drops since 1991. After resetting to a neutral level following the February/March sell-off, it declined further to approximately -1.4 by the end of last week. However, during previous market sell-offs, it tended to bottom at even lower levels. Typically, an RAI reading near or below -2 signals a favorable opportunity to 'buy the dip' or, at the very least, reconsider bearish positions.

Historically, such low RAI levels have indicated improved asymmetry for risky assets. Notably, the likelihood of positive S&P 500 returns over the next 12 months from levels below -2 has been above 90%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!