Institutional Insights: UBS Market Internal Insight

.jpeg)

Market Internal Insight

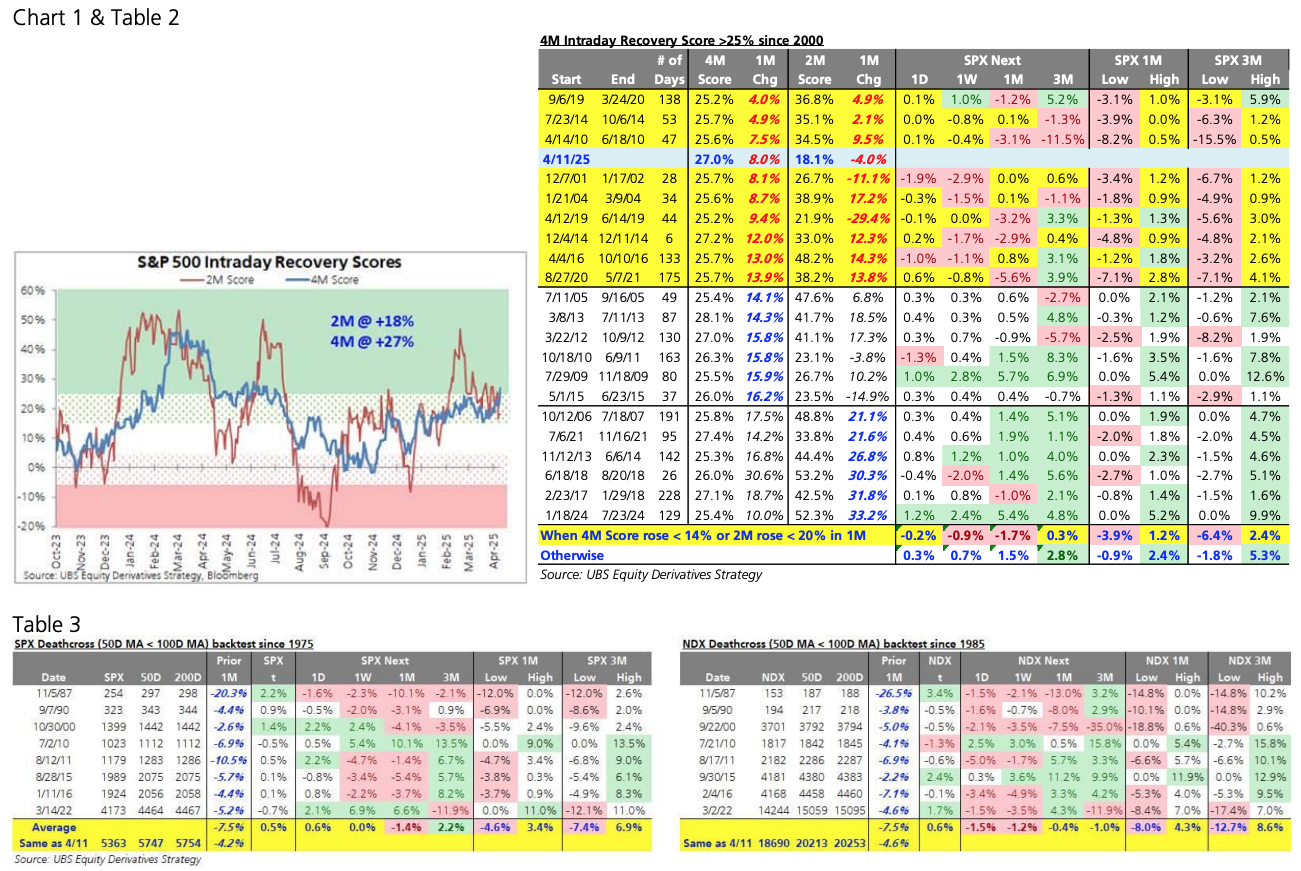

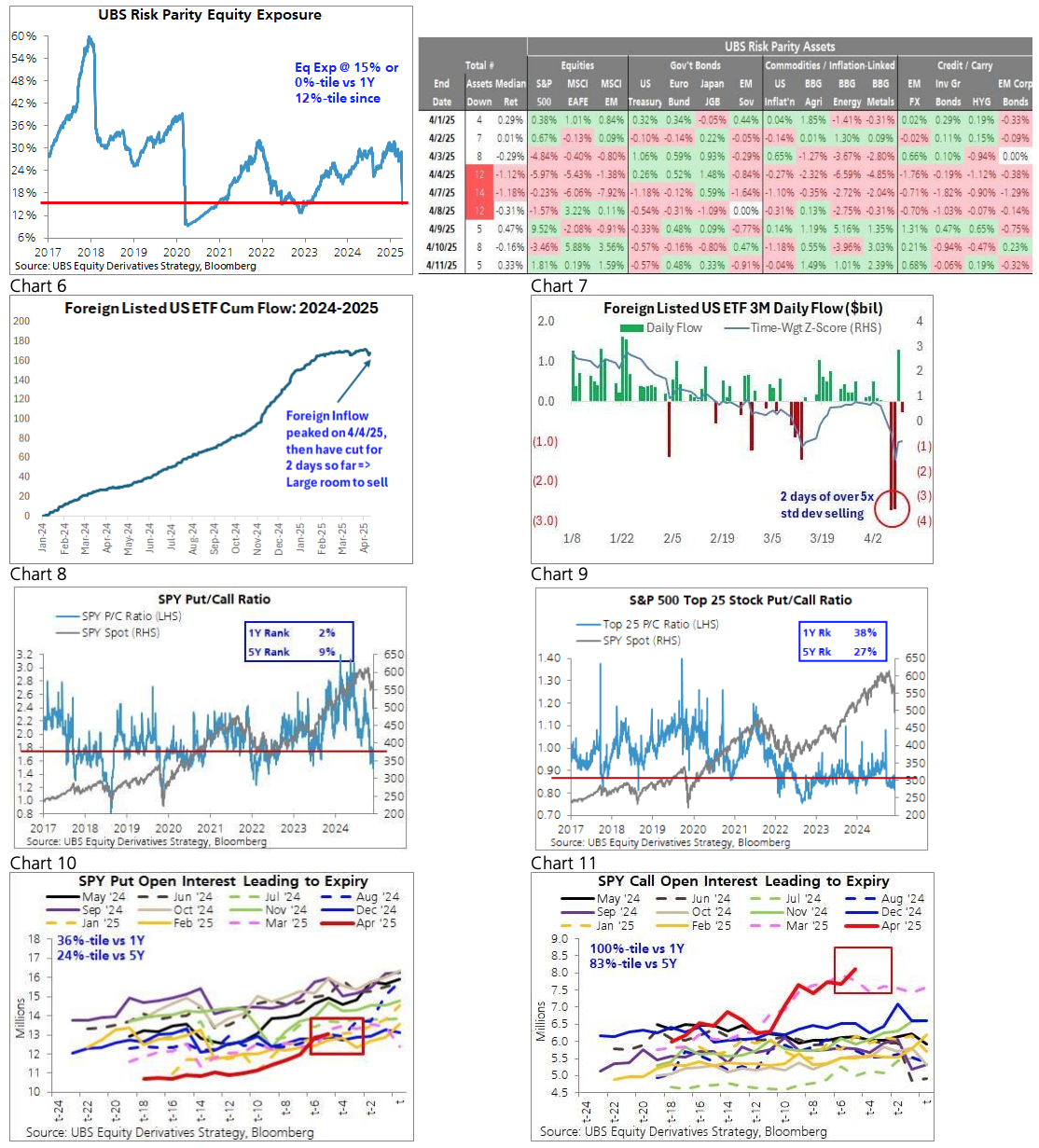

Over the past three weeks, market internal dynamics have been relatively clear, as indicated in recent publications. However, current signals are weaker and more mixed, with a bearish inclination. The delay in tariffs without a resolution is insufficient, as it perpetuates volatility, eroding alpha (return/volatility). If tariffs are lifted or significantly reduced, equities would likely rally regardless of internal market conditions. This explains the low fast money exposure (UBS PB L/S Net at the 17th percentile vs. 1-year and 42nd percentile vs. 5-year) and a market positioning bias towards upside options (SPY Call Open Interest at the 100th percentile vs. 1-year and 83rd percentile vs. 5-year). My primary concern is a risk parity/multi-asset unwind and foreign selling, which could lead retail investors to incur losses on recent purchases and switch to selling. Two market signals indicate short-term downside risk: a 4-month Recovery Score above 25% last Friday with weakening momentum and an anticipated CTA Death Cross for both SPX and NDX.

Recent Market Insights:

1. 3/20: High short interest versus pension rebalance, retail, L/S HF, and foreign buying post-oversold conditions suggested a significant short squeeze risk—advised buying month-end upside.

2. 3/26: Recommended switching strategies to leverage pension pre-buying rallies before tariff announcements.

3. 4/4: Post-tariff announcements, risk control indicated large sellers with capitulation signals in VIX and intraday volatility—predicted a local bottom on 4/6.

4. 4/10: After a historic week, noted overbought conditions following a +10% rally.

Bearish Market Internal Factors:

1. Intraday Recovery Score: Last Friday, the 4M Intraday Recovery Score exceeded 25%, usually a positive signal. However, weakening momentum and a 2M Score Collapse indicated a short-term bearish outlook.

2. CTA Sell Trigger – Death Cross: Expected on Monday for both SPX and NDX unless significant gains occur. Historically, simultaneous death crosses are rare but often followed by market declines.

3. Risk Parity/Multi-Asset Unwind: Recent equity volatility spikes suggest UBS RP model equity exposure may need to be halved. Although volatility typically normalizes, a partial reduction is expected.

4. Foreigner Flow: Significant foreign sales of U.S. assets recently, driven by reduced U.S. exceptionalism and tariff uncertainty, could impact markets.

5. Option Open Interest: Current positioning suggests under-hedged and highly leveraged to the upside, with low put/call ratios indicating vulnerability to downturns.

6. Excess Flow: Despite a significant SPX decline, buying surged post-tariff delay announcement, indicating possible overbought conditions susceptible to downside.

Mixed Market Internal Factors:

1. UBS RMM Flow: Currently supportive but could shift as recent selling suggests potential changes in retail equity exposure.

2. CTA Equity Exposure: Short-term bearish but medium-term supportive, with rebalance scenarios indicating potential for both selling and buying.

3. UBS PB L/S Exposure: Short-term exposure is extremely low, but long-term exposure is modestly low, justified by increased volatility.

Bullish/Supportive Market Internal Factor:

- Risk Control Exposure: S&P 500 Risk Control Exposure remains low, with limited potential for significant selling even with a notable SPX decline.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!