BTC Rally Pauses for Now

Following heavy gains since the November 5th US elections, Bitcoin prices are pausing for now. The futures market has traded up to a test of the 1618% Fib extension of the March – August correction around the $91k mark, where price is currently holding. Given the rapid advance we’ve seen over the last week, come consolidation and correction is expected. However, focus remains on a further push higher given a broadly encouraging macro backdrop now that Trump is due to resume office in January.

Demand For BTC Soaring

A surge higher in institutional demand for BTC ETFs over the last week reflects the growing optimism among crypto investors. The market is widely expecting prices to continue higher in coming months as Trump launches his pro-crypto presidency. Indeed, industry data this week show that many global governments are rapidly increasing their Bitcoin holdings in a bid to capitalise on the expected price gains to come. Bhutan’s Bitcoin holdings hit $1 billion this week while El Salvador’s reserve is now over $500 million.

MicroStrategy Reloads on BTC

We also got news this week that MicroStrategy bought a further 27,000 units of Bitcoin for around $2 billion, its largest purchase since December 2020. The fund has been a huge beneficiary of the crypto rally this year and news of yet a further large-scale purchase is a good omen for Bitcoin bulls.

Technical Views

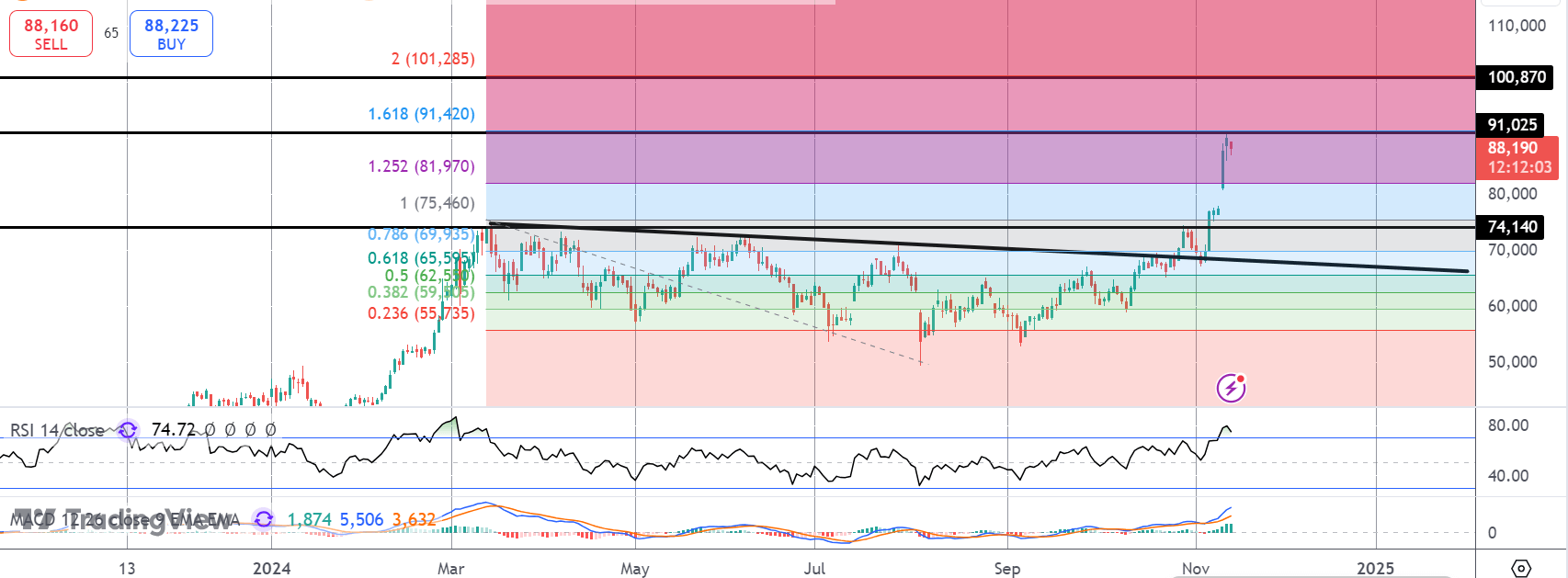

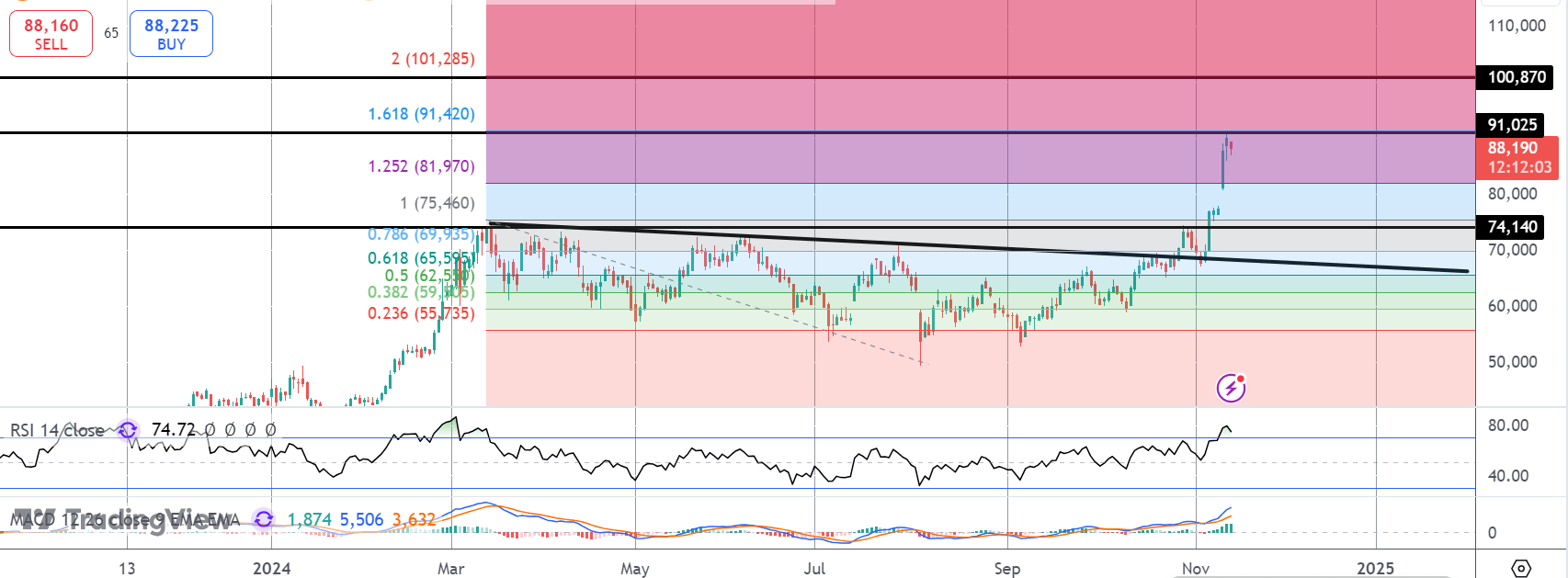

Bitcoin

The rally in BTC has stalled for now into the 1.618% Fib level at 91,025. While above the previous 2024 highs at 74,140 however, the focus remains on a further push higher with the 2% extension at 100 the next bull target to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.