Market Movers: FRC Shares Tank on Liquidity Fears

SVB Fallout

The collapse of SVB has sent shockwaves across financial markets. While the Fed has stepped in to effectively backstop SVB clients, meaning taxpayers wont suffer any losses, broader fears for the US banking sector are weighing heavily on investor sentiment. The Fed announced over the weekend that it would be guaranteeing all of SVB client’s deposits while also announcing a new Bank Term Funding Program to help boost liquidity in the financial sector.

Signature Bank Closed by US Regulators

Additionally, the State Chartering Authority announced that it was closing Signature Bank to avoid the bank suffering a similar collapse to that of SVB due to liquidity strains there. While the Federal Reserve Board has issued a statement declaring that the US banking system is in resilient health and a much better place than pre-GFC, due to widespread reforms, investor uncertainty is clearly visible across financial markets on Monday.

Equities Under Pressure

Fears of broader contagion linked to the collapse of SVB and the closure of Signature Bank have seen stock markets coming under heavy selling pressure. In the UK, the FTSE is selling off sharply today despite news that HSBC has bought the UK arms of SVB, preventing client deposit loss in the UK. With financial sector liquidity concerns likely to remain a key issue going forward, equities look vulnerable to further losses near-term.

FRC Shares Plummet

Shares in First Republic Bank have been heavily sold pre-market as traders bet on it being the next bank to hit the rocks. The bank announced over the weekend that it had secured additional funding from JP Morgan to shore up its liquidity levels. However, the news has failed to convince traders and shares are currently down around 15% pre-market as jitters regarding a potential deposit run build ahead of the US open.

Technical Views

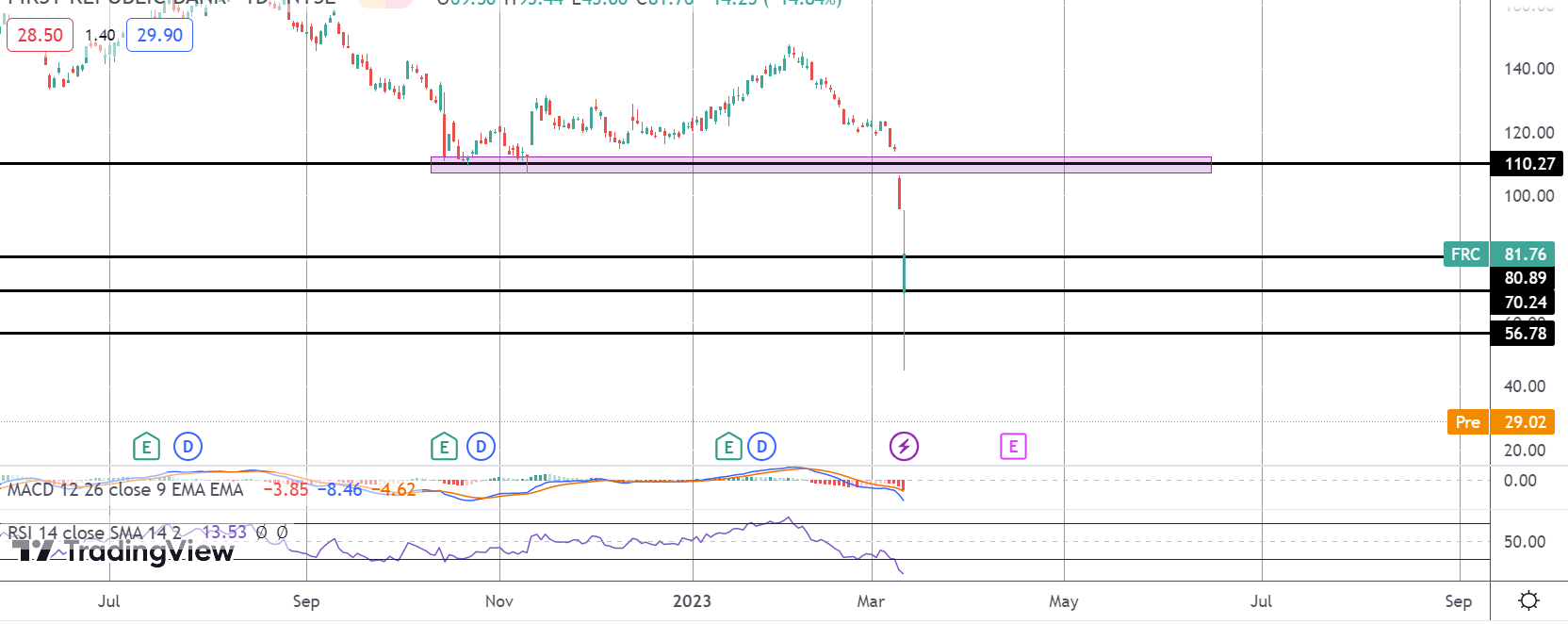

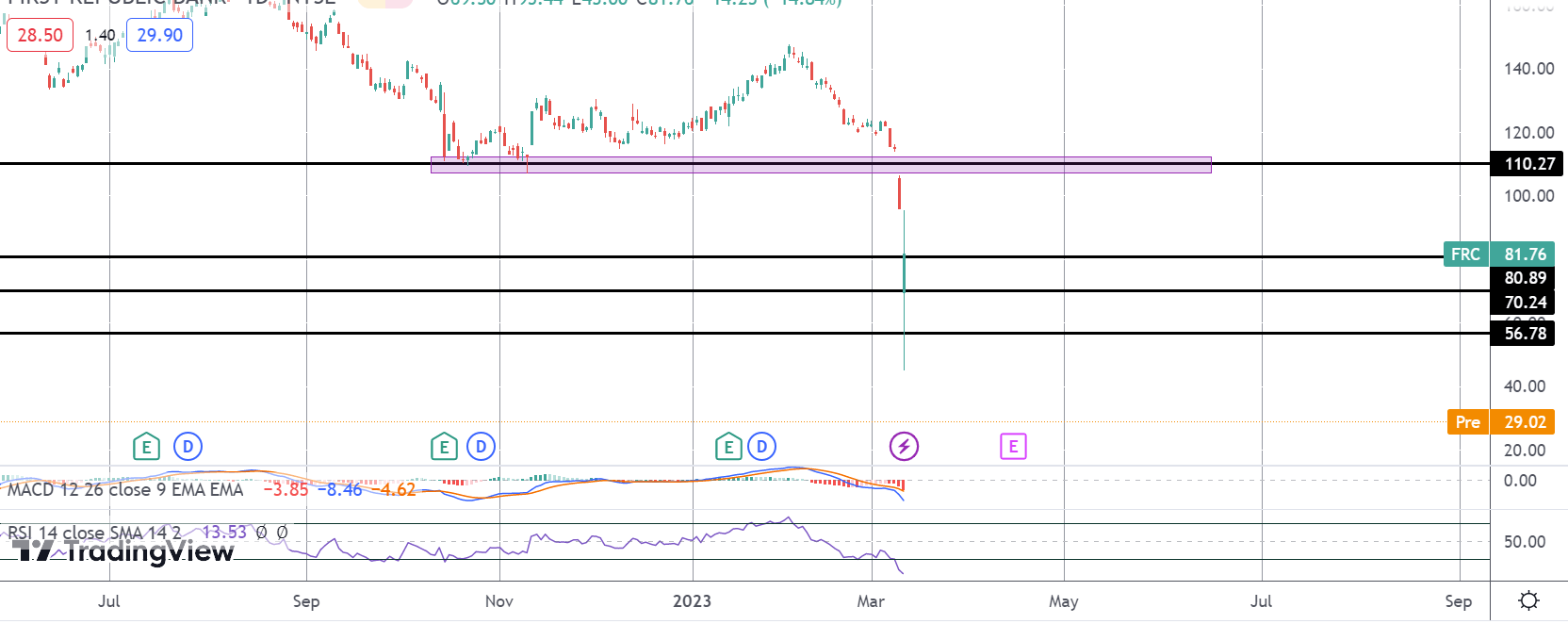

FRC

Following the breakdown below the 110.27 level, the sell off in FRC shares has accelerated quickly. Price is now trading around the $30 mark, well below Friday’s closing $81 level following a roughly 60% decline in pre-market levels from Friday.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.