Market Spotlight: Alibaba Rallies on Buyback News

Earnings Rise, Revenues Miss

Shares in Chinese tech giant Alibaba are trading a little lower ahead of the open today. The move comes after a strong upward move last week in response to the group’s Q3 earnings. Alibaba reported Q3 EPS of $1.81 vs $1.68 expected. However, revenues came in a little weaker than forecast at $29.11 billion vs $29.28 billion forecast.

CEO Cites "Solid" Results

Commenting on the results, which he called “solid”, Chief Executive Daniel Zhang said in an accompanying statement: "The uncertainties of the global landscape have only reinforced our resolve to focus on building capacity that will yield sustainable, high-quality growth for our customers and our own business over the long term."

China Repoening in Focus

Following the results, Alibaba shares rallied as the company outlined details of a huge new share buyback program. Alibaba extended the current $25 billion program by a further $15 billion, and extended the duration to 2025. Furthermore, looking ahead the group was optimistic on the lifting of COVID restrictions in China. While the China reopening story is certainly a major upside risk factor for the stock, traders will be keen to see how the Chinese government reacts to news of new COVID deaths in Beijing with fears of fresh lockdowns likely to be a downside catalyst.

Technical Views

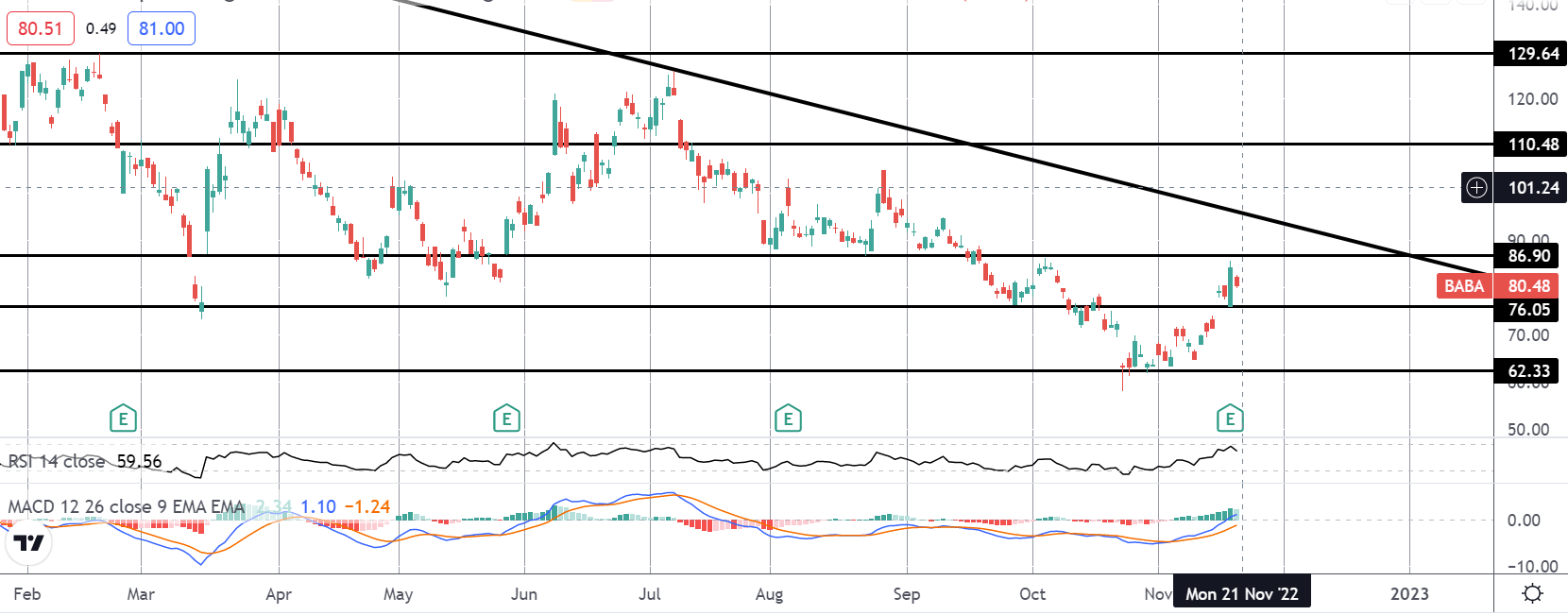

BABA

The rally off the 62.33 lows has seen Alibaba shares trading back up to test the 86.90 level, just ahead of the bearish trend line from YTD highs. With momentum studies bullish here, the focus is on a breakout higher and a move up towards the 110.48 level next while price holds above 76. Below that level, deeper support at 62.33 comes back into play.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.