Market Spotlight: Harbour Energy Reversing QuicklyHigher

HBR Rising

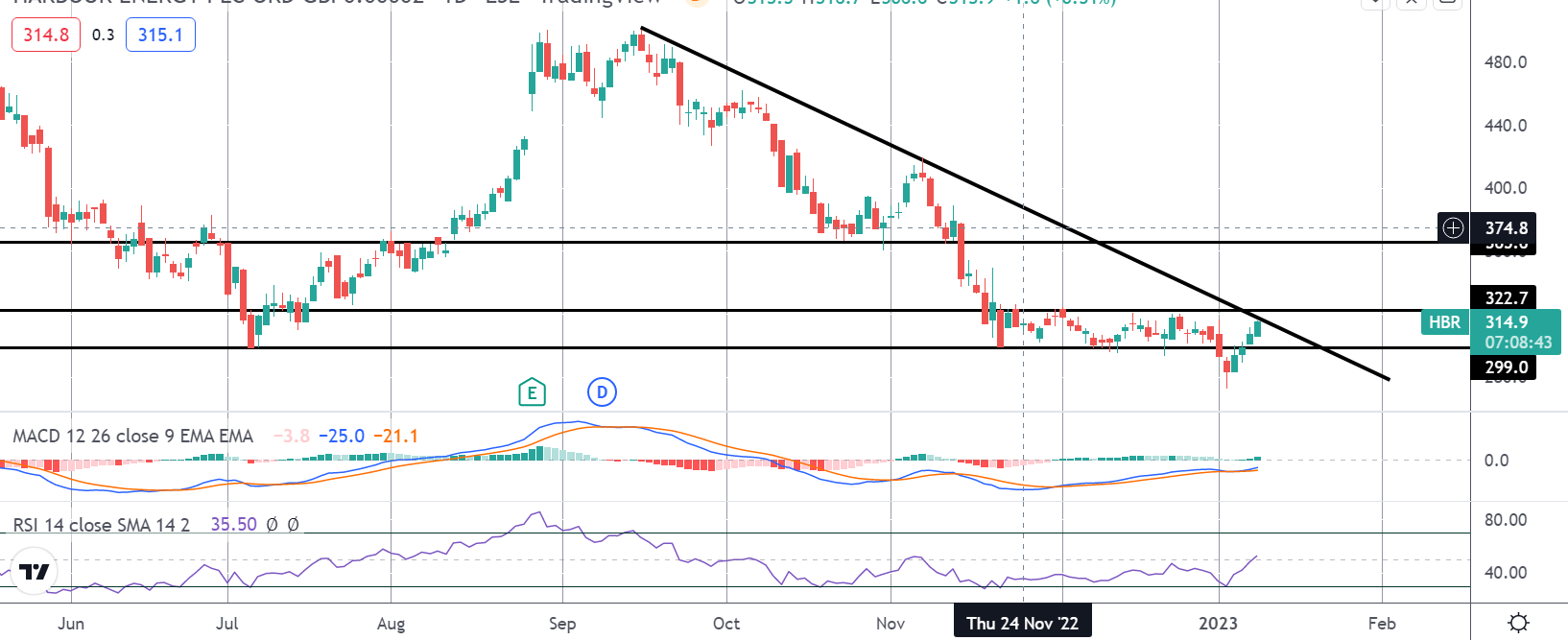

Shares in FTSE 250 listed Harbour Energy PLC are among the biggest gainers on the index today. HBR shares are up nearly 3% from the European open with the stock boosted by the general uptick in risk appetite we’re seeing so far this year. The company which is the largest UK-listed independent oil and gas company has seen its shares rallying around 14% off the initial lows printed last week with price now close to testing the December 2021 highs.

Notably, the move comes despite weaker energy prices over the same period. Harbour recently reviewed its capital allocation in the midst of the windfall energy taxes applied by the Sunak government at the November budget. Harbour refrained from bidding on new projects in the North Sea in light of these taxes, a move which shareholders appear to have backed given the recovery we’re seeing in the company’s stock price early in 2023.

Technical Views

Harbour Energy

The reversal back above the 299 level is an important technical development for the stock, holding the potential to mark a large double-bottom pattern against the July 2022 lows. With momentum studies bullish, the focus is on a further push higher while price holds above this level. The stock is now testing the bearish trend line from 2022 highs with the 322.7 December 2022 highs acting as resistance also. If bulls can break this zone, there is room for a much higher push towards 365.6 next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.