Market Spotlight: Paypal Shares Fall On Spending Fears

Paypal Beats Earnings Forecasts Again

Shares in iconic payment processing provider Paypal are tanking this week on the back of the company’s Q4 earnings. Shares are now down around 12% from last week’s YTD highs. The fall comes despite Paypal earnings falling near enough in line with expectations. EPS came in above forecasts at $1.24 vs $1.19 expected while revenues were just shy of forecasts at $7.383 billion vs $7.389 billion expected. This marked the fourth straight quarter of earnings growth for the company. However, it seems that investors were disturbed by Paypal’s outlook and guidance for the year ahead.

US Economic Concerns

In its outlook for the year ahead, Paypal warned of growing downward pressure on US consumer spending. The group noted its main e-commerce business had slowed as a result of excessive inflation and higher costs for consumers. In a sign of the uncertainty the firm is facing, Paypal deviated from its usual practice of offering revenue forecasts for the year ahead. With fears of a forthcoming US recession and the Fed continuing with its tightening program, Payapl shares have slumped into the end of the week in line with the broader drop in risk sentiment and look set to remain weak in the near-term. Today’s US consumer sentiment might well exacerbate the sell off if we see any weakness against current forecasts.

Technical Views

Paypal

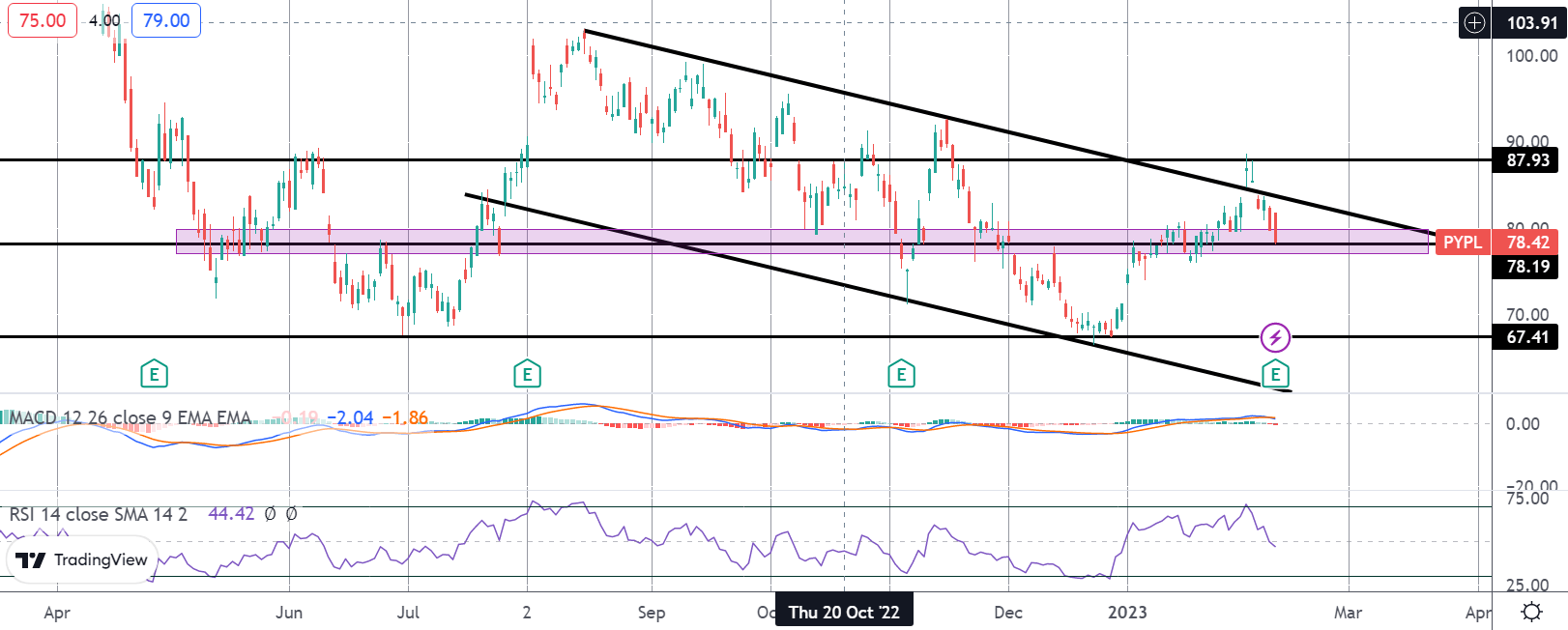

The rally in Paypal shares off the 2022 lows have seen the stock trading up to a test of the 87.93 level, briefly breaking above the recent bear channel. However, the move has since reversed and price is now trading back within the channel, testing the 78.19 level support. This is a key area for the stock and if we break below here, in line with weakening momentum studies, focus turns to a test of 67.41 support next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.