Market Spotlight: State Street Earnings in Focus Today

State Street Up Next

US earnings season rolls on today with State Street among the big names reporting. On the back of mixed results from financial earlier in the week (Morgan Stanley beat estimates, Goldman Sachs missed estimates), traders will now be looking to see which side of the line State Street falls on. The bank is forecast to see an EPS of $1.98 on revenues of $3.03 billion.

Broader Risk Impact

With a solid record of earnings beats (last missed estimates in Q3 2018), a positive set of results from State Street today is the base case scenario and should help lift broader stock sentiment if seen. However, should the company’s results disappoint, this would likely be a major blow to already fragile stock sentiment, dragging stocks lower into the weekend. Of particular note for traders will be the data around credit loss provisions as well as the bank’s overall view on the US economy and recession risks.

Technical Views

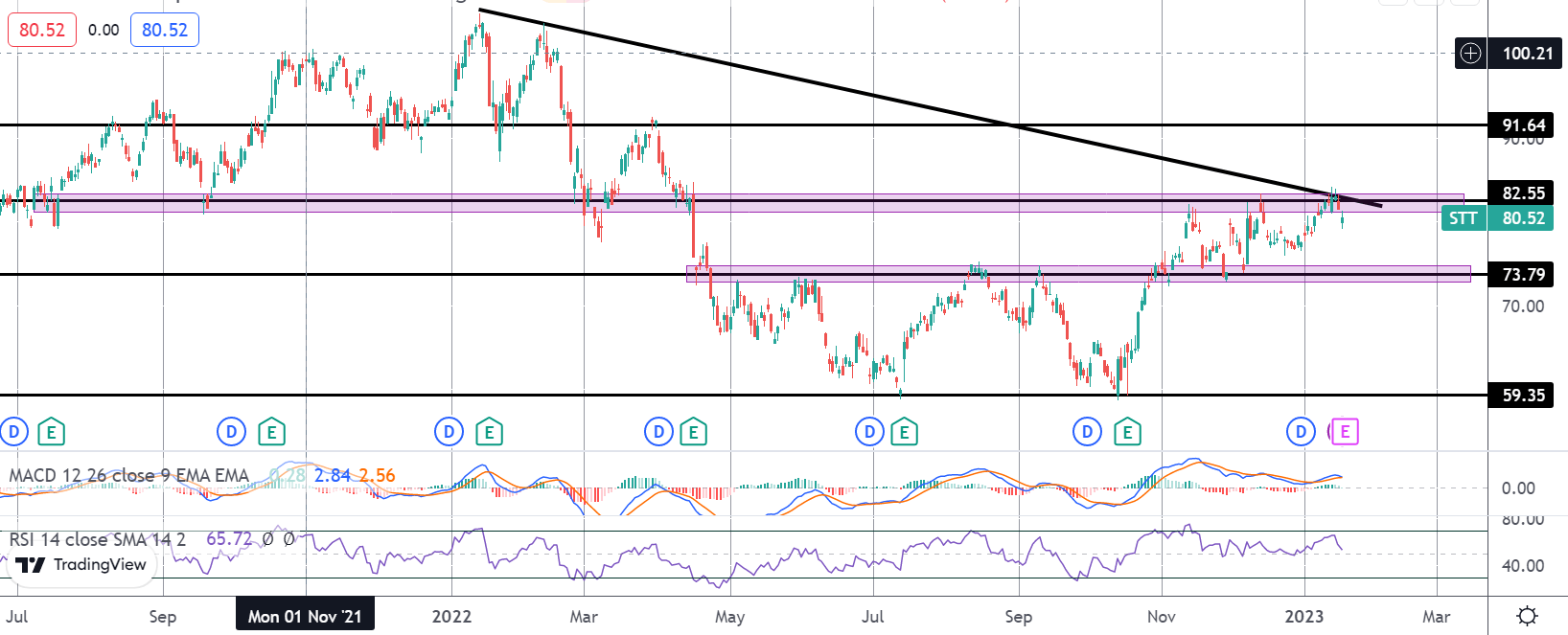

State Street

The rally in the bank’s stock has seen price trading back up to retest the 82.55 resistance area, with the bear trend line from last year’s highs coming in around there also. For now, this area is holding and with momentum studies weakening, a further correction lower looks likely. However, while price holds above the 73.79 level, the outlook remains bullish with the focus on an eventual break of 82.55 and a move up towards 91.64 thereafter.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.