Market Spotlight: Tesla Earnings in Focus Today

Tesla Up Next

As US earnings season rolls on, focus today lands on Elon Musk and Tesla. On the back of Musk’s eventual takeover of Twitter, and all the controversy surrounding it, traders are keen to see how Musk’s primary business performed over the period. On the numbers front, Wall Street is looking for an EPS of $1.12 on revenues of $24.66 billion. This would mark a firm increase on the prior quarter and the eighth consecutive quarter of earnings growth for Tesla.

Musk in Court

Musk is currently on trial facing charges of fraud over a tweet put out in 2018 where Musk claimed he had enough funding to take Tesla private. Shares in Tesla surged on the back of the communication form Musk only to reverse sharply weeks later when Musk said ‘the deal’ was no longer going ahead. This is the latest controversy for Musk who was recently forced to make good on his takeover bid for Twitter to avoid further legal action.

Improving 2023 Outlook

Still, ahead of the group’s Q4 earnings today, analyst expectations for Tesla are firmly bullish. The negative factors which have weighed on the company over the last six months have been thoroughly reflected in price and now with the US interest rate outlook shifting materially and China reopening, the outlook for 2023 has improved considerably which makes Tesla a good candidate for a buy and hold through the year. Tesla has slashed vehicle prices recently on two key models which should help feed into better demand this year while the company will also benefit from reductions in prices of key commodities used in its manufacturing process.

Technical Views

Tesla

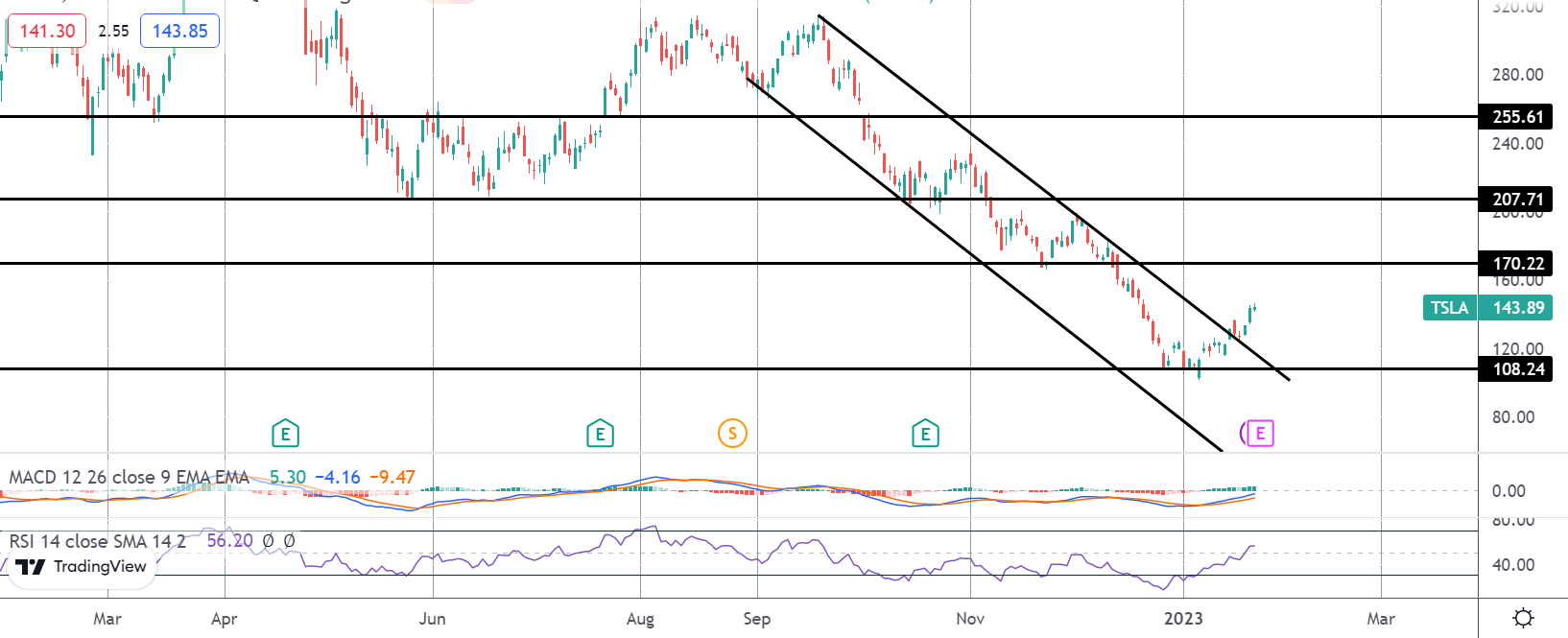

The decline in Tesla from summer 2022 highs has been framed by a clearly mapped bear channel. However, after stalling into a test of support at 108.24, Tesla shares have since turned higher and are now attempting to break out above the bear channel. The key level to watch will be the 170.22 region, a break of which will turn the near-term outlook firmly bullish with 207.71 the next target for bulls.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.