PLTR Pops on Earnings But Tech Stocks Under Pressure Ahead of UDS CPI

PLTR Beats Forecasts

Shares in Peter Thiel founded tech company Palantir were seen exploding higher yesterday. PLTR stock gapped open following the release of Q1 earnings after the bell on Monday and pushed on to end the session around 25% highs from Monday’s closing price. Looking at the breakdown of Q1 results, PLTR posted EPS of $0.05, better than the $0.04 the market was looking for, on revenues of $525.186 million, again better than the $505.824 million the market was looking for. Both earnings and revenues were seen rising from the prior quarter and are sharply higher than the same quarter a year earlier.

2023 Profit Guidance Raised

Looking ahead, Palantir raised its full year profit guidance which now sits in the $2.19 - $2.24 billion zone up from $2.18 - $2.23 billion prior. For the current quarter, the firm projects revenues of between $528 - $532 million, a little higher than market expectations. Near-term, the path of US equities around today’s US CPI print will be key for PLTR stock. Shares are trading a little lower pre-market, reflecting uncertainty ahead of the data. If CPI come sin above expectations, tech stocks look vulnerable to a pullback here with PLTR likely to give back some of Tuesday’s gains.

Technical Views

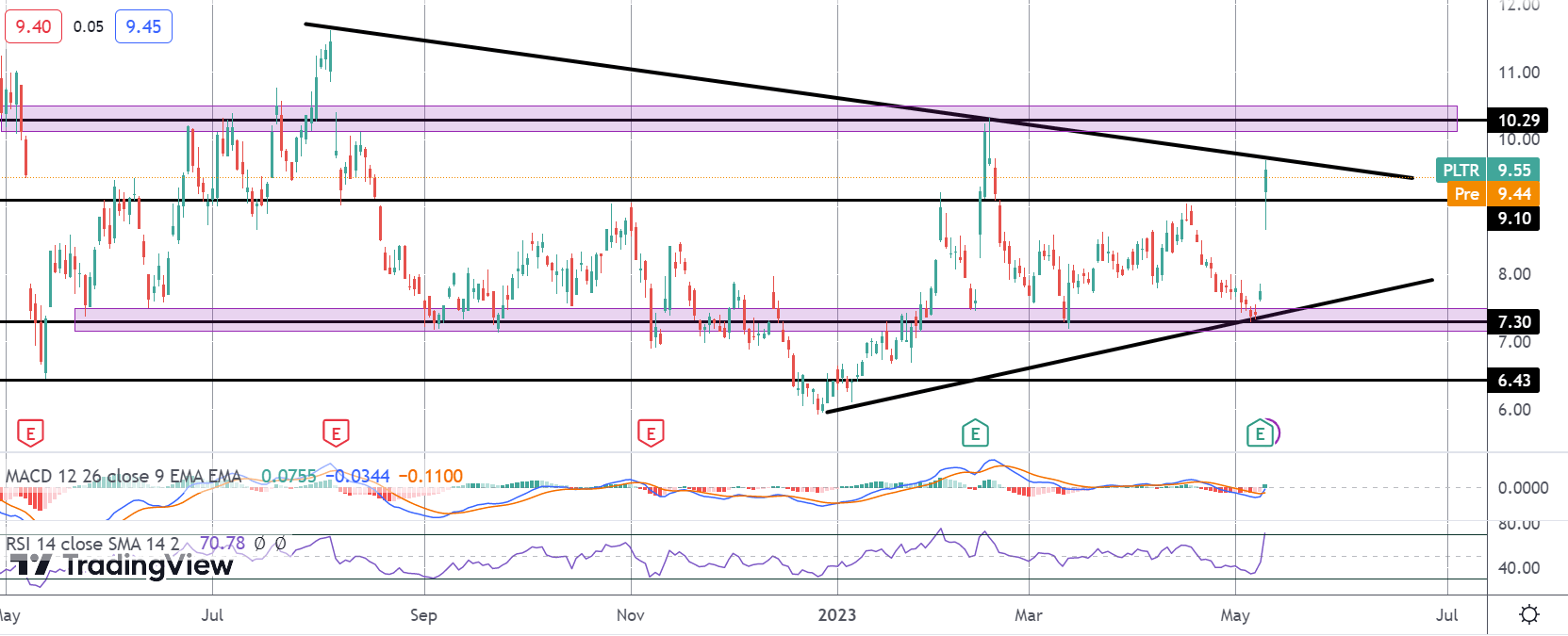

PLTR

Following the breakout above the 9.10 level, the market has stalled into the latest test of the contracting triangle top. While 9.10 holds as support, however, the focus is on a further push higher with 10.29 the key objective for bulls. To the downside, back below 9.10, the triangle lows and 7.30 level will be the key supports to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.