Silver Plunging Amidst Post-FOMC Fallout

Silver Prices Dropping

Silver prices are softening ahead of the weekend, tracking the move lower in gold, as fresh strength in USD hits commodities sentiment. The March FOMC was quite a mixed bag, however, the fallout from the meeting looks to be favouring a stronger Dollar, creating near-term headwinds for silver prices. While the Fed lowered its dot plot forecasts, now projecting two cuts down from one, Powell warned that the bank is in no rush to cut rates and an upward revisions to inflation forecasts has caused some confusion with traders eyeing risks that the bank turns less dovish if inflation starts to push higher as expected.

Trader Uncertainty

The Fed was seen taking a tone of concern over the US economy in light of the risks from Trump’s trade war. The prospect of higher unemployment but also higher inflation makes the Fed’s job very difficult in terms of finding the right monetary policy path to take. As such, markets are in a period of flux now as traders digest the details of the meeting and look to establish a directional bias.

Bearish Risks

If USD strength continues near-term, silver prices look vulnerable to a fresh move lower amidst a broader downturn in commodities prices. There are some offsetting factors, however, with Trump’s tariffs expected to cause a supply squeeze in silver which could help underpin prices. The big question now is whether the current USD rally fizzles out or starts to gain proper momentum.

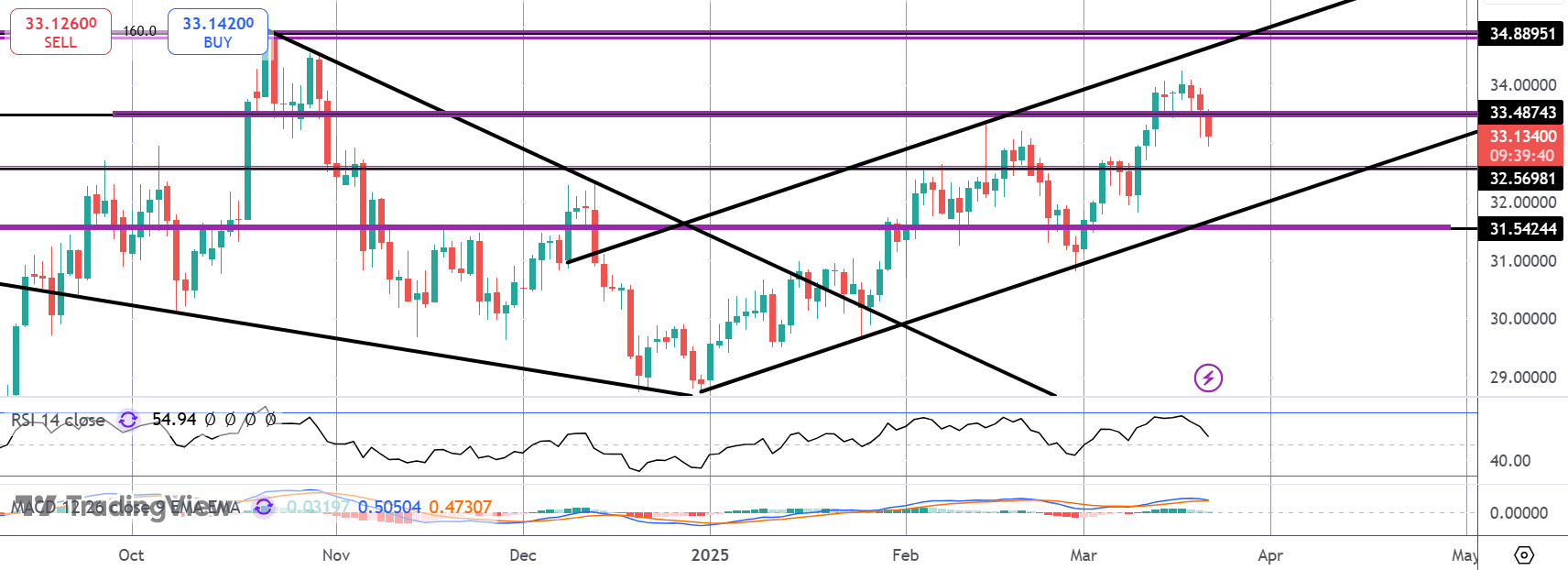

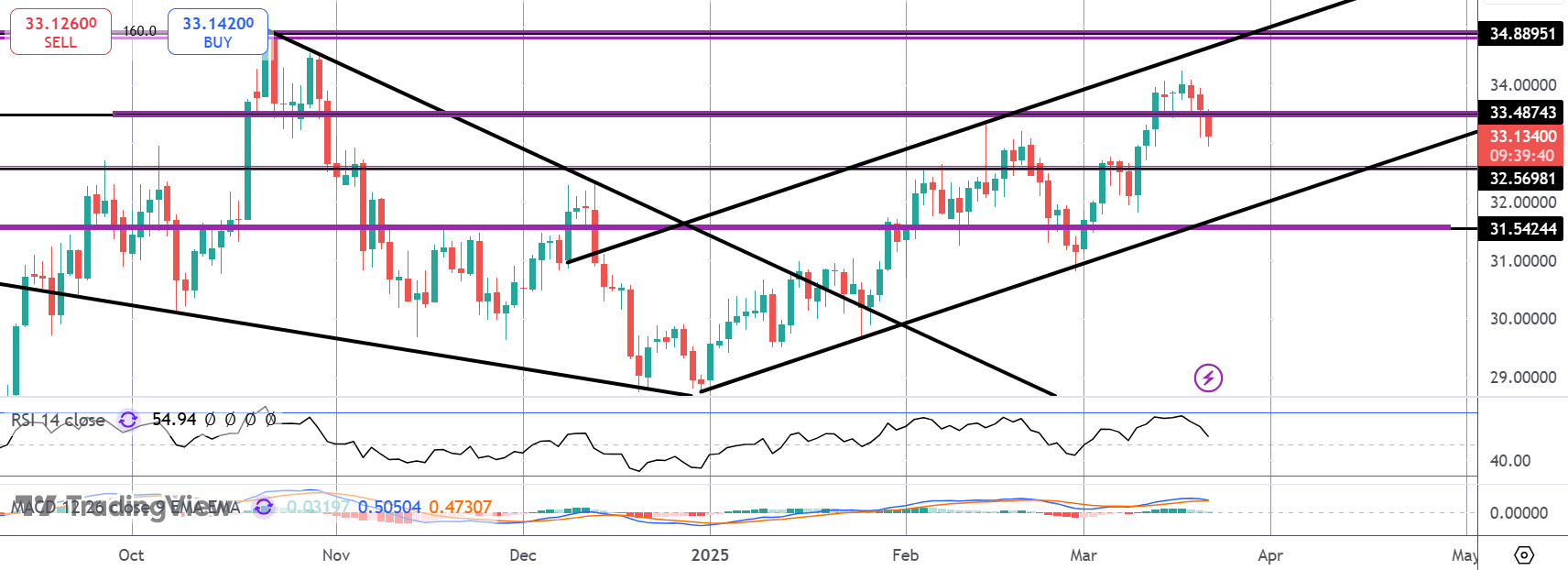

Technical Views

Silver

The rally in silver prices has stalled for now into the 34 level with price since slipping back below 33.4874. Fading momentum studies readings suggest room for a deeper correction with 32.5698 and the bull channel lows the next support zone to watch. Bulls need to defend this area to maintain the broader bullish outlook and keep focus on the 34.8895 level target.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.