SP500 LDN TRADING UPDATE 6/03/25

SP500 LDN TRADING UPDATE 6/03/25

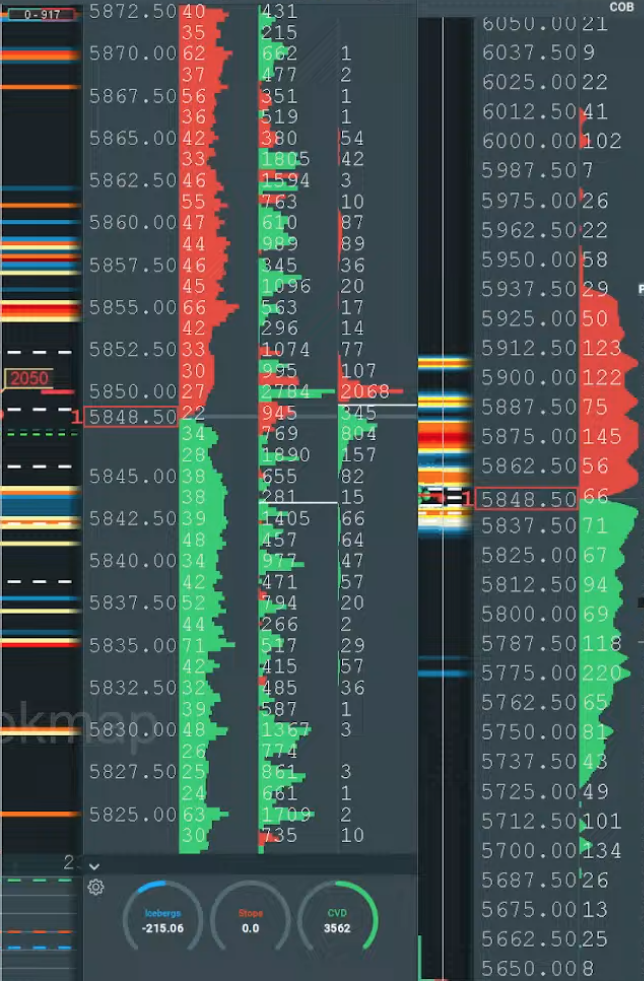

WEEKLY BULL BEAR ZONE 6025/35

WEEKLY RANGE RES 6080 SUP 5836

DAILY BULL BEAR ZONE 5820/10

DAILY RANGE RES 5887 SUP 5803

EQUALITY TARGET AGAINST 6000 SWING HIGH 5680

5680 MONTHLY PROJECTED RANGE SUPPORT

WEEKLY ACTION AREA VIDEO

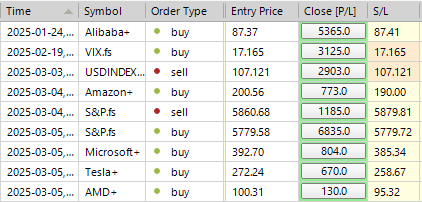

TODAY'S TRADE LEVELS & TARGETS

SHORT ON TEST/REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

LONG ON TEST/REJECT OF DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: A SIGH OF RELIEF

FICC and Equities | 5 March 2025

The S&P 500 climbed 1.12%, closing at 5,842 despite a market-on-close sell order of $200 million. The Nasdaq 100 (NDX) gained 1.36% to end at 20,628, the Russell 2000 (R2K) rose 1.02% to 2,100, and the Dow Jones Industrial Average advanced 1.14% to 43,006. Trading volume across U.S. equity exchanges totaled 15 billion shares, slightly below the year-to-date daily average of 15.3 billion. The VIX increased 7.06% to 21.85, crude oil dropped 2.81% to $66.34, the U.S. 10-year Treasury yield edged up 3 basis points to 4.28%, gold rose 0.09% to $2,920, the DXY dollar index fell 1.38% to 104.29, and Bitcoin surged 3.07% to $90,196.

The market’s positive momentum was fueled by reports that the U.S. may delay auto tariffs on Canadian and Mexican imports for one month, driving shares of Ford and GM up 5-7%. Semiconductor stocks, particularly Analog Semiconductors (ON, NXPI, STM, IFX), saw strength amid an absence of negative news, which investors interpreted as a positive signal. On the macroeconomic front, the ADP employment report missed expectations at 77k versus a forecast of 140k, while factory orders and durable goods data came in line with estimates. ISM Services improved, with stronger new orders offsetting rising prices paid. However, retail faced headwinds, with Abercrombie & Fitch (ANF) missing by 10%. Energy stocks lagged as crude oil prices hit their lowest close since September following bearish DOE and OPEC+ reports.

Trading activity was rated at a 5 on a 1-10 scale, with net buyers adding +334 basis points compared to a +30 bps 30-day average. Long-only funds were net buyers of $1.7 billion, driven by demand in technology, consumer discretionary, and utilities, while healthcare and industrials saw lighter supply. Hedge funds ended as slight net buyers (+$300 million), supported by discretionary demand despite supply in tech and energy.

DERIVATIVES

The volatility "panic" index reached 9.7/10 earlier today, its highest level since the VIX spike on August 5th. While volatility and skew eased slightly, the broader technical outlook remains challenging. Dealers remain short approximately $1 billion of SPX gamma, a position that has stayed stable even during the recent rallies. This dynamic, coupled with liquidity factors, has contributed to the week’s average intraday range of 246 basis points. Client activity was lighter today, though there was notable demand for IWM weeklies ahead of Friday’s Non-Farm Payroll (NFP) report. Given the heightened realized volatility, straddle pricing for the remainder of the week is set at 1.64%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!