The FTSE Finish Line: January 20 - 2025

FTSE To Test All Time Highs On Trump Optimism

The FTSE 100, London's leading stock index, was trading near its all-time highs on Monday as investors looked forward to Donald Trump's return to the White House for new perspectives on his views regarding tariffs and international relations. The index of top British companies rose by 0.2%, remaining just below the record level reached on Friday. Trading activity was low due to a holiday in the U.S. Trump, who has promised to sign numerous executive orders related to immigration, energy, and tariffs on his first day in office, is set to be inaugurated as U.S. President at 1700 GMT. Traders are worried that his proposed tariffs on China and other nations could lead to inflation and negatively impact global growth. This week, attention is also on the annual meeting of government and business leaders in Davos, along with various earnings reports. Global stock markets experienced a surge last week after data indicating a slowdown in inflation in both the U.S. and the UK encouraged traders to increase their expectations for further rate cuts from the Federal Reserve and the Bank of England. Currently, traders are anticipating an 81% likelihood of a 25 basis points rate cut from the BoE early next month, with a total of 62 basis points of easing expected by the end of 2025. Meanwhile, the FTSE 250 midcap index fell by 0.5% following a four-day streak of gains.

Single Stock Stories:

Entain's shares fell by 1.7%, positioning it among the largest decliners on London's blue-chip index. This drop came after the announcement that the UK's accounting regulator has initiated an investigation into KPMG's audit of Entain for the financial year ending December 2022. A representative from KPMG UK indicated that the firm will fully cooperate with the investigation. In 2024, Entain's stock has decreased by roughly 30%.

Shares of mining services company Capital dropped 8.4% to 75.7 pence, ranking among the top losers on London's small-cap index, which rose 0.07%. Earlier in the session, the stock declined as much as 13.4% to 71.8 pence, marking its lowest level in over three and a half years. The company reported full-year 2024 revenue of $348 million, falling short of its forecasted range of $355-375 million. According to Capital, the revenue shortfall was due to delays in the ramp-up of a contract with Nevada Gold Mines. Trade volume surged to more than four times the 30-day average of 135,725 shares. Year-to-date in 2024, Capital's shares have fallen by 10%.

Shares of oilfield services company John Wood Group increased by 3.5% to 70.8 pence, positioning it among the top gainers on the FTSE midcap index, which has risen by 0.34%. The firm revealed a long-term maintenance contract to deliver solutions for both onshore and offshore assets in the Gippsland Basin, managed by Esso Australia. This contract is scheduled to begin in January, although no financial specifics were provided. Despite this positive news, the stock has fallen by roughly 61% in 2024.

Broker Updates:

Shares of Reach jumped 18.8% to 85.5p, positioning it as the leading percentage gainer on the FTSE small-cap index, which rose by 0.8%. The publisher of the Daily Mirror and Daily Express revealed that it anticipates its operating profit for fiscal 2024 to surpass market expectations. Analysts predict an adjusted operating profit of £97.8 million ($119.3 million) for the year ending December 31, 2024, based on company-compiled consensus. Reach also announced plans to contribute an extra £5 million in 2025 to the West Ferry Printers Pension Scheme after uncovering a historical mistake. Analysts at Panmure Liberum pointed out that the company had previously signalled strong performance and likely exceeded expectations for the full year, achieving over £2 million in additional savings. In 2024, the stock saw an 11.2% rise.

Technical & Trade View

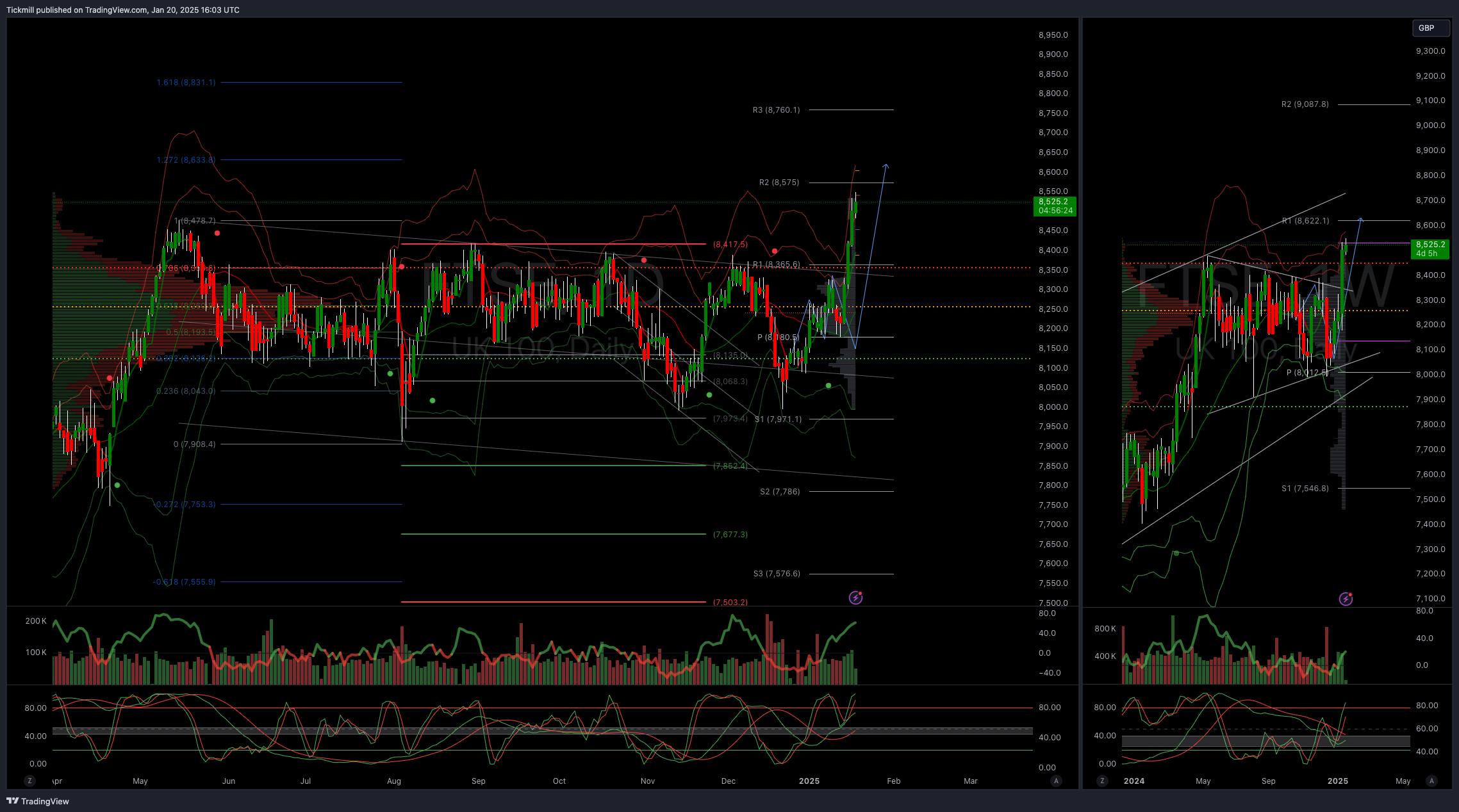

FTSE Bias: Bullish Above Bearish below 8225

Primary support 8000

Below 8000 opens 7855

Primary objective 8600

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!