The FTSE Finish Line - July 18 - 2023

The FTSE Finish Line - July 18 - 2023

FTSE Finds Its Footing Supported By Ocado & Homebuilders

FTSE 100 index is up 0.22% on an overall positive session driven by Shares of Ocado Plc, the British online supermarket and technology group, surged by as much as 19% to a five-month high, making it the top percentage gainer on London's bluechip index. The company announced that it had swung to a half-year adjusted core profit of £16.6 million ($21.7 million) from a loss of £13.6 million. Ocado reaffirmed its annual outlook and reported a 9% increase in half-year revenue. It also anticipated that its joint venture with Marks & Spencer, called Ocado Retail, would achieve a marginally positive EBITDA in the fiscal year. Analysts at Jefferies commented that there is clear upward pressure on consensus expectations for the full-year 2023. However, some analysts at Interactive Investor noted that while there are still positive factors, such proponents are becoming fewer as time goes on, given the company's progress continuing to underwhelm. Prior to this positive news, the stock had experienced a decline of around 6% this year.

Further positivity came from the The UK housebuilders' index has risen by 4% ahead of the release of the country's consumer price inflation data for June, scheduled for Wednesday. Investors in house building companies are sensitive to consumer price data, and the recent figures from market researcher Kantar, indicating a decline in food inflation, have been well received as markets start to reassess inflation driven interest rate rises by the Bank of England, as a result, FTSE 100 companies Persimmon and Taylor Wimpey have seen their shares increase by almost 5%, while Barratt is up 4% and Berkeley is up 2%. The annual grocery inflation, according to Kantar's data, was 14.9% for the four weeks ending July 9, representing a decline of 1.6 percentage points from its June data set. If the gains hold, the housebuilders' index is set to record its best day in over five months, and it is up 4.7% year-to-date.

On the negative side of the negative side of the ledger Rentokill once again takes the bottom spot shedding 1.16%

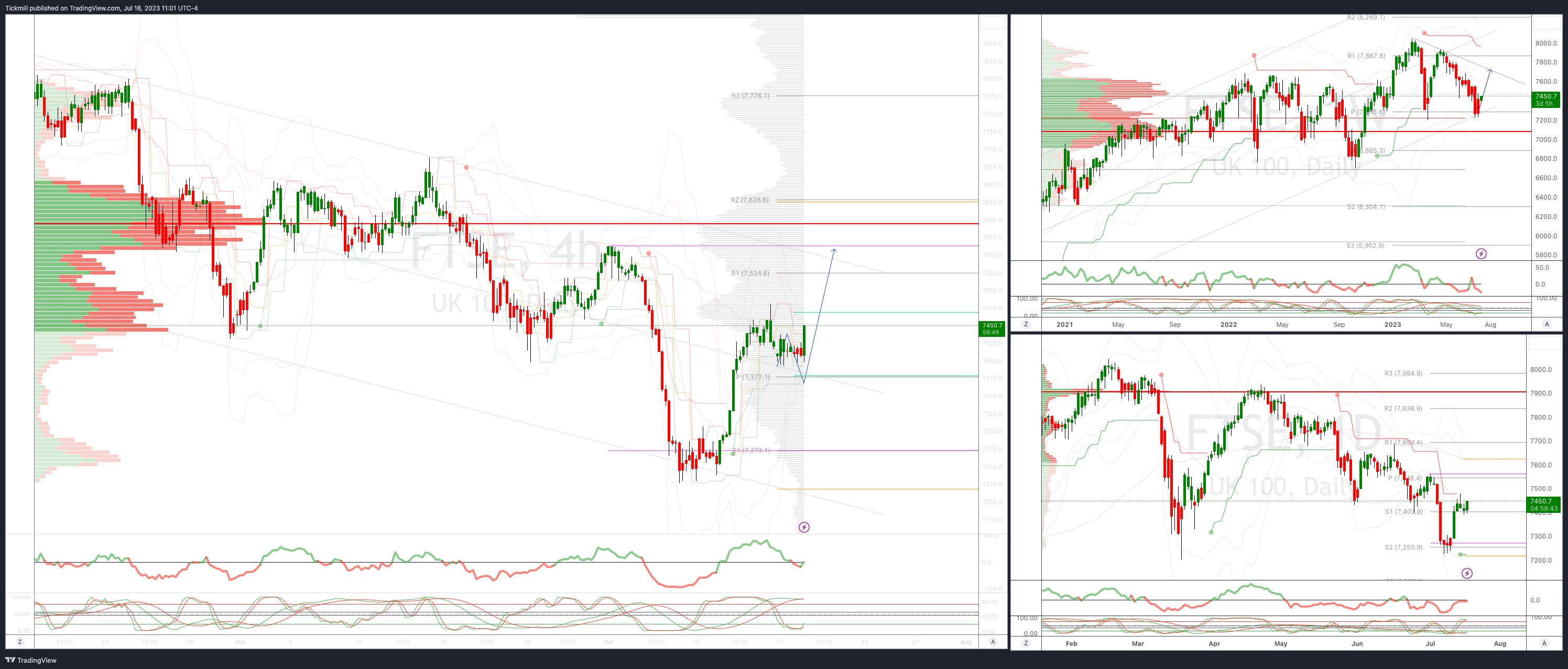

FTSE Intraday Bullish Above Bearish below 7400

Above 7550 opens 7660

Primary resistance is 7600

Primary objective 7538

20 Day VWAP bearish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!