Institutional FX Insights. Goldman Sachs Trading Views Dollar & Yen

USD: Funding Rotation Reversal – More Comfortable With USD Shorts

Yesterday’s session could be rated as highly engaging in terms of client inquiries (5/5) but relatively lackluster in client flow activity (2/5). This imbalance highlights some frustration, as the market lacked strong fundamental drivers. Despite weaker U.S. data and political commentary on FX and upcoming jobs data, the DXY index remained largely range-bound, with xJPY showing more significant movement. Reflecting this, flows yesterday leaned towards unwinding the funding rotation seen earlier this year, with clients reducing CHF and JPY shorts against the dollar and other currencies. Notably, JPY dynamics are discussed further below.

Broadly speaking, with last week’s USD buying program now behind us and Real Money USD supply resuming, we anticipate the dollar’s move lower could persist. This is particularly likely as the market continues to weigh the China/UST developments from earlier this week more heavily.

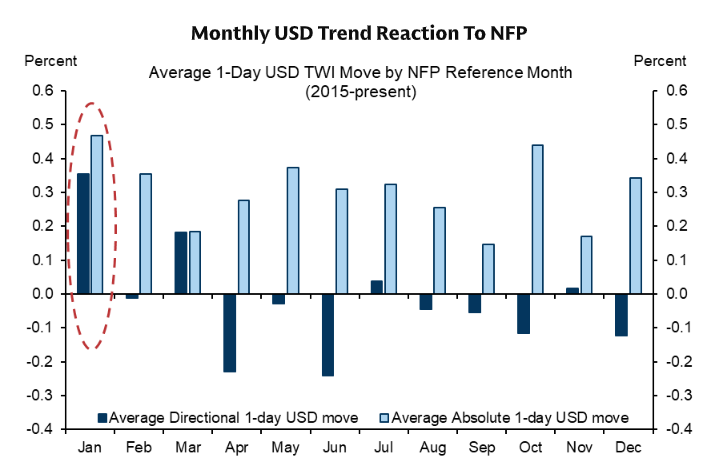

Looking ahead to today’s session, attention will center on the NFP report. However, we are skeptical about its lasting impact, given the Fed’s current stance of staying on hold and the increased data volatility in January reports, partly due to annual benchmark revisions. GS Economics projects a below-consensus NFP figure of +45k (versus a consensus of +65k), aligned with softer private sector job growth indicators, adjustments from the birth-death model reducing jobs by 30-50k, and unchanged government payrolls. The team also expects the unemployment rate to remain steady at 4.4% and average hourly earnings (AHE) to rise by +0.35% MoM, in line with consensus.

While the dollar trend has been challenging to counter this week, we believe too much weight has been placed on recent U.S. official comments leading up to the data release. This increases the likelihood of a dollar bounce post-NFP, consistent with historical trends. Following the data release, remarks from Fed voters Bowman and Hammack will also warrant close monitoring.

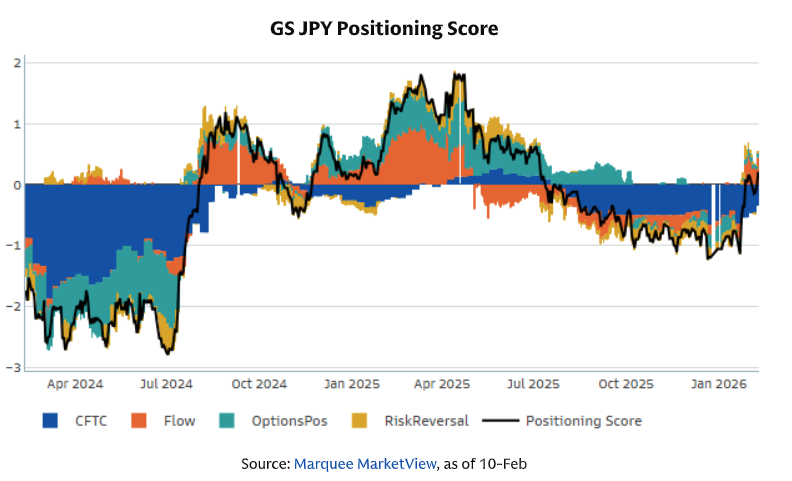

JPY: Significant JPY Buying Programs, But Appears More Offshore-Driven

Recent sessions have shown an acceleration in JPY movement, notably during NY trading hours, aligning with substantial hedge fund flows—marked by selling in both USDJPY and xJPY. This shift likely reflects adjustments in FX funding (as discussed earlier) and appears to be driven by forced flows following the failure of the post-election USDJPY rally to materialize. This has resulted in clients either stopping out of JPY shorts or pivoting toward JPY longs.

However, prior to today’s session, local flows were more mixed and, if anything, leaned the other way, with importers actively buying dollars week-to-date. Consequently, we remain cautious about chasing this JPY rally, given skepticism surrounding the ‘buy Japan’ and ‘repatriation’ narratives. Our preference remains with USD shorts in other areas across G10 and EM currencies. That said, the scale and broadening of JPY buying throughout the week make it challenging to dismiss this move.

Regardless of your stance, I strongly recommend revisiting the GS FX & Rates Research note, which outlines the essential framework for sustained JPY strength. In summary, intervention alone will not yield lasting effects unless complemented by:

Faster BoJ rate hikes (partially priced in),

Fiscal tightening (evidence of greater restraint compared to pre-election expectations), and

Local repatriation (still uncertain).

From a technical perspective, USDJPY decisively broke below the 100-day moving average and the bottom of the cloud level around 154.50 yesterday, paving the way for a potential move toward the year-to-date lows near 152. This level could be tested, especially on a weaker-than-expected NFP print later this week.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!